IF cash is tight, you might have considered pawning some value.

It could perhaps be jewellery, a wrist watch or perhaps a handbag.

The cost-of-living crisis has witnessed a boom in pawnbroking loans – where money is made available in return for a valuable item which, if repayment is not met, might be sold.

But experts warn that loans are costly and if you can't service the debt you could lose a having sentimental value.

This week Sun Money investigates these loans and provides advice on affordable alternatives.

EXPENSIVE RATES

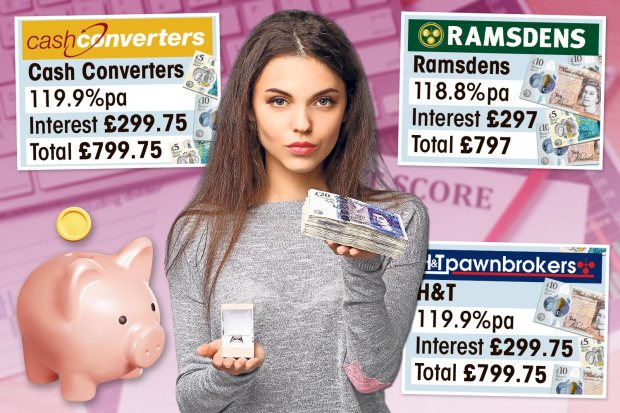

YOU will finish up paying back hundreds of pounds in interest. Three of the UK's biggest pawnbrokers, Cash Converters, Ramsdens and H&T, charge between 118.8 percent and 119.9 per cent each year.

This means should you took out a loan for lb500 over six months you would need to pay back lb299 in interest or lb799 as a whole, for a price of 119.9 per cent.

The loans are far pricier compared to those from high-street banks, but less expensive than pay day loans.

Many pages and use a monthly or daily rate of interest however they should also show the annual rate.

Often you can only borrow a percentage of an item. For instance, in case your ring was worth lb200, you may only be in a position to borrow lb100. You sometimes need to repay the borrowed funds in one payment.

An H&T spokesperson said: “We serve customers who are not in a position to raise funds within the traditional banking credit system, or who require a small-value, short-term loan to meet an immediate funding need.”

AFFORDABILITY FEARS

PAWNBROKERS don't perform credit checks. This is often an advantage if you have a poor credit score but it means there are no safeguards to make sure you can afford the borrowed funds.

Debt adviser Sara Williams, of Debt Camel, said: “Some people discover they redeem an item but that has left them so lacking money they are forced to pawn it again in a few weeks.

“A one-time convenience turns into a long-running nightmare, especially if you are pawning jewellery with sentimental value.”

An Financial Conduct Authority spokesperson said: “We have reformed the market to help borrowers avoid getting into a spiral of debt and have been clear with lenders concerning the have to support customers if they are struggling.

“We will require action if firms don't meet their obligations.”

IF YOU DON'T REPAY LOAN

IF you make repayments promptly, you can get the pawned item back. However, you must keep the receipt.

If you lose it and the item is over lb75, you'd have to pay a fee to get a magistrate or commissioner of oaths to swear the products are yours. If you can't repay the loan, the product comes.

James Daley, of Fairer Finance, said: “Avoid pawning any item with high sentimental value unless confident in what you can do to repay.”

If your item does get resold, you should get sent any other money the pawnbroker gets – above that which you were offered for it.

James adds: “In the past, pawn-brokers have been poor at reuniting customers with this extra cash.

“So should you pawn something and it does get in love with, check what it sold for and chase down cash you are owed.”

AFFORDABLE ALTERNATIVES

IF you need to take a loan, take a look at alternative options. Remember, emergency credit should only be utilized in extreme circumstances, maybe to pay a priority bill or maybe your car breaks down.

If you're on a low income or have an undesirable credit rating, you might find it difficult to entitled to the top high-street loan rates. This is exactly why affordable alternatives are important.

First, try to obtain free cash in the type of grants. If on benefits, speak to your work coach about the Household Support Fund. Or ask your local council if they can help.

Or Jane Tully of the MoneyAdviceTrust, suggests: “Credit unions often offer a range of affordable products at cheaper rates and there is a cap on the amount of interest they can charge.”

If having problems paying a bill, confer with your provider.

Use Turn2Us to look for grants or speak to End Furniture Poverty, if you want furniture or a new fridge-freezer, for instance.

Responsible lenders like Fair For You offer lower-cost loans to help buy home essentials. Iceland does interest-free micro loans of lb75, in the form of a pre-loaded card to invest in the supermarket.

You can seek free debt advice from Citizens Advice, StepChange or National Debtline.