Rural areas continue to be facing challenges in the Great Recession – a clear, crisp downturn in economic productivity that occurred between 2007 to 2009.

While all America was affected by the current recession, rural areas especially struggle to move in the same pace as urban areas. And as a result, these rural communities across the country continue to be struggling to recover their local markets and boost their small businesses.

Many smaller businesses need additional funding to boost profitability. Whether that's to acquire new equipment, personnel, property or seasonal inventory. Rural businesses face even more challenges within the entrepreneurial sphere from the market in particular. This is why you can find rural development programs meant to benefit both new business organisations and the community they serve.

In to stimulate rural communities with new, stronger market development, their local businesses need to have the assets and manpower to develop. This is exactly why rural small company grants have grown to be essential. They can provide those additional assets required for communities being more entrepreneur-friendly. The extra money in turn encourages small business growth that produces more occupations and infuses the local community having a livelier market that may be competitive with urban businesses.

The question is, what qualifies a little rural business proprietor for a grant?

How does the government define rural communities to start with?

The answer to these questions should be straightforward, but there's lots of ground to cover. With a number of grants, loans and services open to rural communities, among the best places to start is the currently available grants for rural development and where they come from.

As we take you step-by-step through everything vital that you learn about rural small company grants, we'll also give you more details about whether or not you qualify for one and how to start obtaining the funding you need.

Should explore receive or qualify for a rural small business grant, we’d still prefer to assist with the growth of the small company. You can feel liberated to apply for funding with us today!

Rural Development Grants at a Glance

The U.S. Department of Agriculture has a variety of programs and services expressly made to help develop rural communities. The kind of funding here ranges widely, from helping prospective tenants find housing to funding water and waste disposal.

In terms of business, programs like the Business & Industry (B&I) Loan Guarantee can help smaller businesses in a number of ways, for example:

- Funding the expansion, modernization, repair or conversion of the business.

- Purchasing and developing land, easements and other buildings or facilities to develop a business.

- Purchasing equipment, rentals, machinery, supplies or inventory.

- Debt refinancing when it improves income and allows a company to offer more jobs.

- Acquisitions of companies and industrial providers for the purpose of creating or saving jobs.

While there are a variety of restrictions for these programs (which we'll enter into later), rural small business loans can offer those guaranteed loans you have to infuse your company with increased profitability while providing more jobs to the local community.

The B&I loan program we mentioned previously has flexible maximum loans (7 – 3 decades, depending on the loan's purpose) and only a one-time guarantee fee along with a yearly renewal fee.

When you're looking for grants specifically, you will find the options of dealing with government grants or private ones: both have their advantages and disadvantages. Government grants like those for rural business development include funding, technical assistance and practicing applicable businesses. Public entities like towns, communities, state agencies, authorities and more are all potential applicants.

You may also find other federal organizations that encourage small businesses to take part in research for grants, like the SBIR program. In the case of SBIR, the aim would be to stimulate economic growth through technology while providing entrepreneurship opportunities for social and economically disadvantaged minorities.

Rural Small Business Grant Requirements

It is sensible that the first requirement of prospective grant awardees could be using a business inside a rural area.

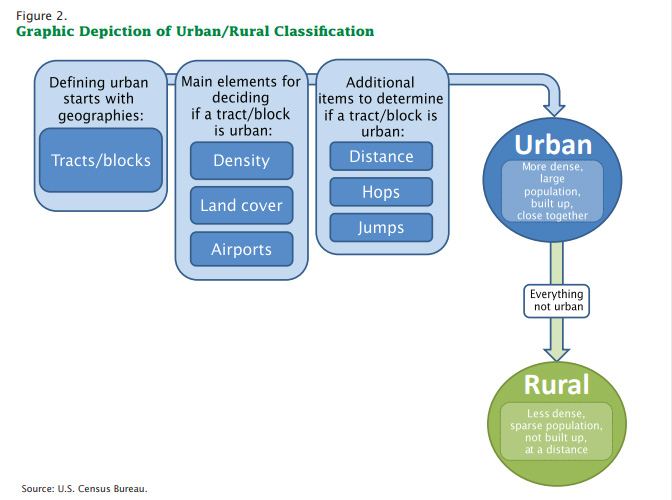

But what defines 'rural?'

Even inside the federal government, there's lots of different definitions for it. In most cases, however, a province is regarded as a place with less than 50,000 inhabitants that isn't adjacent to an urban area.

Other grants (like those used for improving telecommunications or waste disposal) may define rural areas as smaller locales, but most rural small business programs come under that first definition.

Who Qualifies for Rural Development Programs?

The qualifications vary from grant to allow, especially among private organizations. The us government classifies potential applicants as “Rural public entities,” including from nonprofit corporations towards the towns and communities themselves.

Guaranteed loans offer even more flexibility, because the government will help fund everything from manufacturers and retailers to the people and public bodies. Any size of business might be found eligible, but there are obvious restrictions for several industries.

Generally speaking, the smaller your grant or amount borrowed is, the higher priority it is to become funded.

What are you currently Permitted to use a Rural Business Development Grant?

Government grants are given using the specific intent to enhance the rural area all around the business, so any business investment that accomplishes this can be a valid utilisation of the funds. This could include training and technical assistance (business counseling, researching the market, project planning, etc.), the acquisition of land, pollution control, adult learning for job training, improving rural transportation along with a wide selection of other expenditures that help the rural community in particular.

Guaranteed loans have similar approved uses, for example purchasing equipment, developing business acquisitions, and covering startup costs.

What must you Obtain a Grant?

Getting a grant isn't quite as straightforward as filling out an online application. In order to apply, you need to be pre-registered using the System for Award Management and have a Data Universal Number System number. While it doesn't have a price to create these registrations, it can take a lot of here we are at your data to be processed before you can apply for a grant. This is particularly relevant over the states, where grant deadlines vary according to in which you are actually applying from.

Before you signal inside your application, you will also need to have important information all set to go. Including:

- Evidence of the job creation which may happen if your business expanded,

- The percent of non-federal funding you've dedicated to your project,

- The economic need of your business's area (and just how well your business plans aligns with those needs) and

- Evidence of the experience dealing with similar small company building efforts.

How do You Obtain a Rural Development Grant?

The best spot to begin with the application is by using your state office, which can furnish you with program specific information a state offers.

As we've discussed earlier, you'll also need to pre-register with the System for Award Management before you can obtain a government grant. That means creating a merchant account with the System for Award Management, completing a web-based application, and looking out through public record information to find existing entity registrations or exclusion records.

You'll also need a Data Universal Number System number. The information Universal Number System, or D-U-N-S, is really a number assigned to every business that interacts using the authorities. Once you register, your D-U-N-S number assists to validate, identify and link your business inside the federal system, which in turn helps you and also the government track the progress of a grant you've requested.

Applying for the System for Award Management as well as your D-U-N-S can take time, so it's important to understand this done prior to applying to a grant. Deadlines can pass quickly and aren't the same across the U.S., so the sooner you prepare, the easier it will likely be to apply for a grant or guaranteed loan out of your state office.

What other Funding Options are There?

The typical problems small businesses encounter can be the identical in rural areas. Most finance companies and banks have relatively stringent requirements, which often incorporate a certain amount of value in a business's assets, remarkable ability to prove consistent income along with a good credit score.

It's often easier for smaller businesses to have their funding from lending companies or grants (which can be found from more than just the federal government). Even companies like Wells Fargo and Walmart offer grants made to help small businesses grow, so you can find funding from private companies as well as the government when you need money for a rural business.

Develop Your company with Small Business Funding

Small business loans/funding are our specialty. Without having time to hold back for the government to process a grant or else you don’t obtain a grant approval, you can look at the various funding options we've available.

Helping rural communities develop due to the business you bring is just one of the many together with your work we do.

Try applying today to see what we can perform for you.