So you are in need of a business loan – lucky for you personally there are a ton of options. You can always see your local bank a treadmill from the other big banks in your town. Or you are able to secure a loan with an online alternative lender.

You know what a bank is, but you might not know about alternative lending.

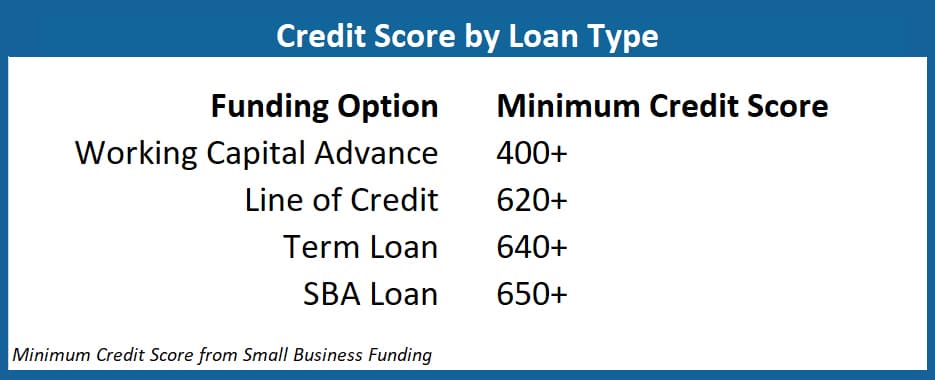

An alternative lender is really a financial organization that gives funding options by means of a Working Capital Advance, SBA Loan, Line of Credit, Term Loan or any other means to fix smaller businesses, beyond traditional bank lending and typically in which the entire process is finished online.

But which option is best for the success of your business?

Here can we review the differences from a traditional bank versus an alternate lender, including which option would be perfect for your business.

Ease of Funding

One from the primary reasons companies consider alternative lending is simply because the chances of these getting approved are greater.

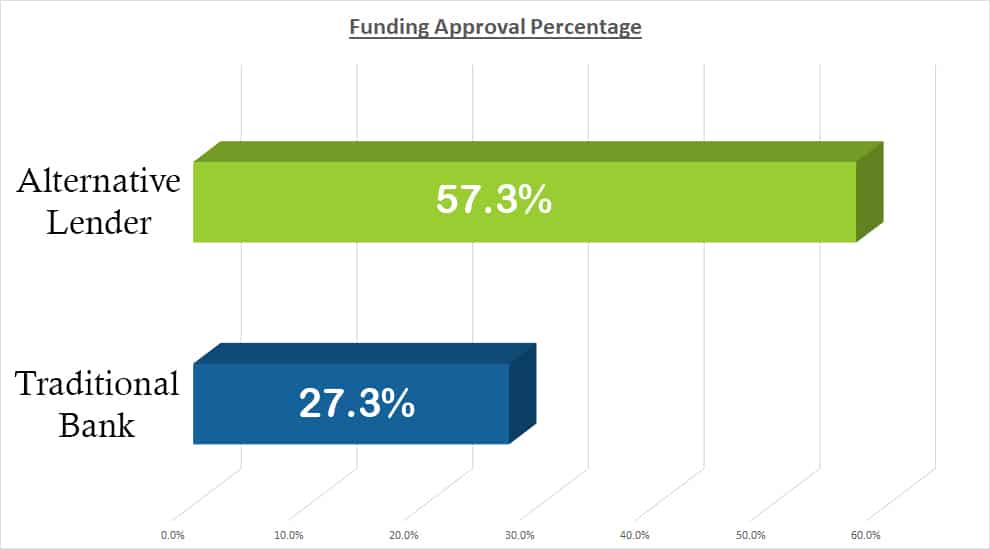

Below are the approval percentages for small company loan applicants at traditional banks versus alternative lenders (sources: Forbes).

Some of the causes of the disparity are outlined below.

Credit Score

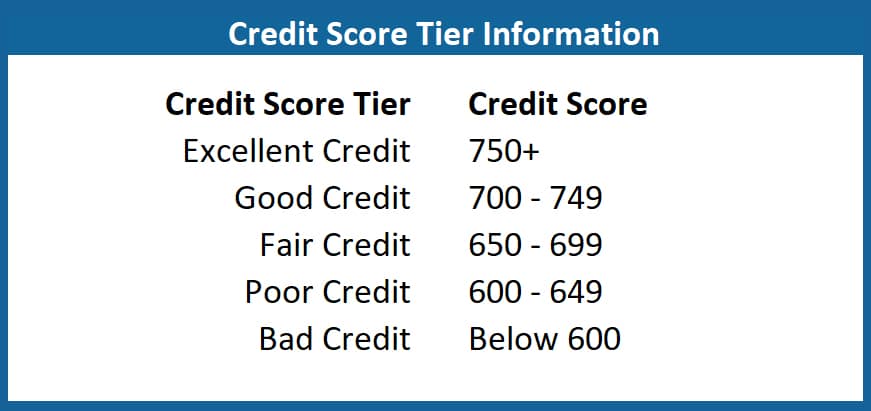

One of the biggest factors differentiating funding from the bank vs an alternative lender is the personal credit score, or FICO.

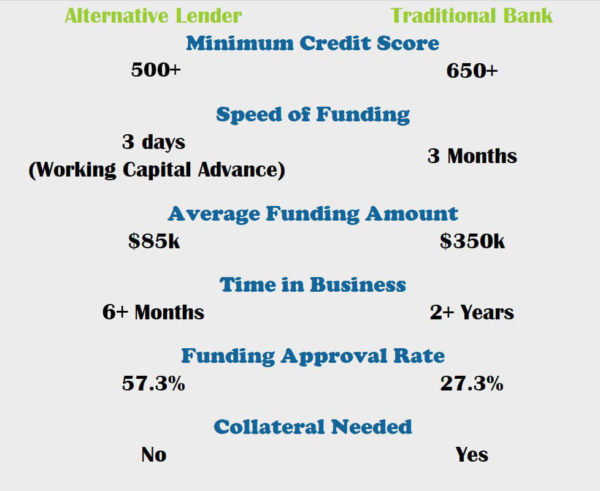

Every bank’s credit rating requirements will vary but typically a bank will need a credit rating of 675 or more. With lower credit scores producing a higher rate of interest.

By contrast, several lenders carry a minimum credit rating of 500.

Most alternative lenders are prepared to look past low credit score because they place more emphasis on the healthiness of your company. Specifically, alternative lenders want to see when the cash flow can in fact support repayment in the short term.

Where your credit score will come into play is in determining what funding options your business may be eligible for a.

Age of Business

According towards the Small Business Administration, about 20% of businesses fail the first year. In order to minimize their risk, lending organizations will need the absolute minimum amount of time in business. However, chronilogical age of business for banks and alternative lenders derive from how long you have had a business bank account, not necessarily how long you have had your business.

For example, at Small Business Funding you want to see that you've been running a business at least A few months, and that the business generates gross monthly revenue with a minimum of $8k to be able to potentially be eligible for a business funding.

Keep in mind this is the minimum, and some in our funding options will have slightly higher requirements

Most traditional banks will require a minimum chronilogical age of business of two years.

Collateral

Collateral is the securing of assets such has property, equipment, automobiles, etc. that a lender can reclaim and sell should you not satisfy your debt.

Depending on the business type of loan, traditional banks may require security from default by means of collateral. They uses a loan-to-value ratio to look for the amount you are able to borrow. This value is typically 60%-80% from the assets appraised value.

Alternative lenders don't always require collateral.

So so why do banks require collateral, but alternative lenders do not?

Simple, banks want to make a profit from every loan. If there's a chance you may default, they want to ensure they are able to secure some assets to market.

Alternative lenders will also be running a business to make money but view smaller businesses because the backbone in our economy.

Small Business Funding, for example, views our small business clients like a partner. As such, when you’re successful, we'll be successful. It's within our best interest to ensure you possess the funding needed to grow your business.

Some in our funding options, like a Capital Advance, actually allow for adjustments in repayment terms depending on the most recent month’s revenue.

Average Funding

The average funded add up to a small company from an alternative lender is $85,000, however the range varies from less than $5,000 to $1 million.

Conversely, the average funding from a bank is $350,000. Depending around the bank, they've already the absolute minimum loan dependence on $50,000 – $100,000 but will fund up to a several million dollars.

Interest Rates

Not all funding options provided by alternative lenders carry mortgage loan, plus they might have repayment terms which are according to your company's revenue. Those funding products that will have mortgage loan are usually higher than a traditional bank.

Traditional banks can keep their interest rates low simply because they minimize their risk by funding less risky businesses, people with a strong personal credit score and good reputation for making payments on time.

Time Involved

The initial process with a bank may take as much as 60 – 3 months only for an approval.

Why such a long time?

Banks possess a system where multiple officials and employees review your application. In accessory for this process, there is a lot of paperwork which must be completed and reviewed.

In many instances, an alternate lender may have an answer in your funding status within 24 hours of submitting a completed application, and you may potentially receive that funding within 3 days (sooner in some cases). This will depend on the funding option you're entitled to, and whether you are approved.

Paperwork

Traditional banks require significantly more upfront paperwork to accomplish an application than an alternate lender.

Below is a comparison.

What's Good for you?

Both kinds of lenders have their pros and cons. Ultimately the lender you decide to go with usually depends on several factors including:

1 – your individual credit score

2 – how quickly you need funding

3 – how much cash you need

4 – how long you have been in business

5 – your level of comfort

6 – period of loan

Initially, your options might depending more on your individual credit rating. If your score isn't strong, the best choice (and perhaps your main) is by using an alternate lender. With low credit score, your total repayment amount will be higher, and the payback period will be shorter.

In this case it might make sense to acquire a loan/advance by having an alternative lender. Use this method when you work to raise your credit score, like a higher credit score could open up more funding options later on. At minimum you're creating a good reputation for on-time payments with the alternative lender. This could make obtaining a second loan/advance with this lender easier.

If you've got a strong credit score, you've more options. You will likely be able to get the best rate and terms with a bank. But if you default, you run the chance of losing the assets you put as collateral. With an alternative lender, we will use you if you're having problems making payments. Again, your ability to succeed is our success.

Beware of shopping for the best rate and terms with multiple banks. Each bank will probably run your credit score every time. Multiple credit pulls in a short time frame will start to decrease your score.

Small Business Funding includes a network of lenders it works with, so you don't have to shop. We will work with our partners to find the finest option based on your company needs.

Let us know your ideas on FACEBOOK and TWITTER

Click icons below to share.