PAYDAY lender PiggyBank has gone bust leaving a large number of customers in limbo over repayments and compensation.

The company specialised in lending cash for between lb100 and lb1,000 to borrowers with poor credit, charging through the roof rates of interest of up to 1,698.1 per cent APR.

The short-term loans needed to be repaid over periods of between 7 days and five months.

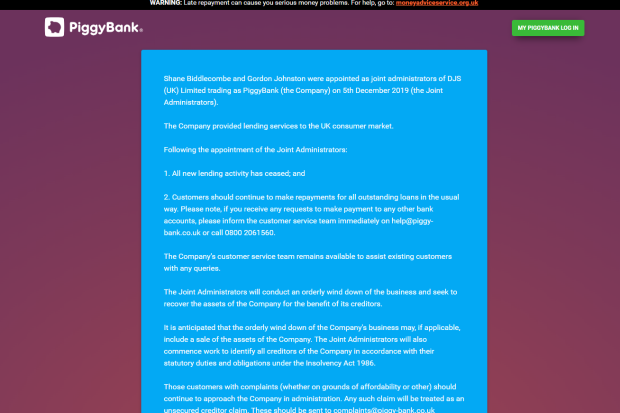

According to the website, the organization entered administration on December 5. It was last reported to have around 45,000 borrowers around the books.

The struggling firm had been temporarily banned from providing money in July this season over concerns that it was lending irresponsibly.

It's the latest in a string of payday lenders entering administration following a demise of 1 of the UK's biggest short-term lender, Wonga, in August this past year.

Lender 247Moneybox closed shop last week, and QuickQuid, WageDayAdvance and Juo Loans also called it a day earlier this year, plunging countless customers into financial uncertainty.

Many of them buckled under the influx of compensation claims over irresponsible lending.

Customers who still owe PiggyBank cash are now being urged to carry on making their debts normally.

Otherwise, they risk damaging their credit score or just being hit with a lot more charges like a penalty for late or missing payments.

Borrowers who have already submitted compensation claims, and those who are yet to, is going to be added to a long list of creditors that are owed cash.

Both are unlikely to get a payout as the bigger lenders like banks and investors is going to be paid first.

Wonga customers inside a similar position have reported that they've since received compensation payouts even after it went bust but they have been much smaller than anticipated.

Borrowers will also be being urged to stay alert to scammers who may be trying to profit from the company's demise.

Customers are encouraged to ignore email and phone calls that keep these things alter the bank account they normally make repayments to.

Instead, they ought to contact the client help team immediately on [email protected] or call 0800 2061560.

Administrators Shane Biddlecombe and Gordon Johnston haven't rules out the sale of the company to pay off a number of its debts.

In an argument on the PiggyBank website, administrators said that they "will commence work" to repay people who the organization owes money to.

It added: "The organization remains regulated by the Financial Conduct Authority who will continue to supervise the joint administrators' activities through the administration process."