A LOGBOOK loan borrower has spoken of his horror following the firm sent him personal information of some other customer.

Stephen Middleton, 32, said he was "shocked" at how irresponsible lender MobileMoney have been following a employee emailed another customer's name, and workplace address and phone number to him in error.

Gas engineer Stephen said: "I don't understand how they could be so stupid, I couldn't believe it.

"I was shocked because when inconsiderate they could be with someone's details.

"Surely they have a duty of care to look after customer data?

"He's probably a customer like me."

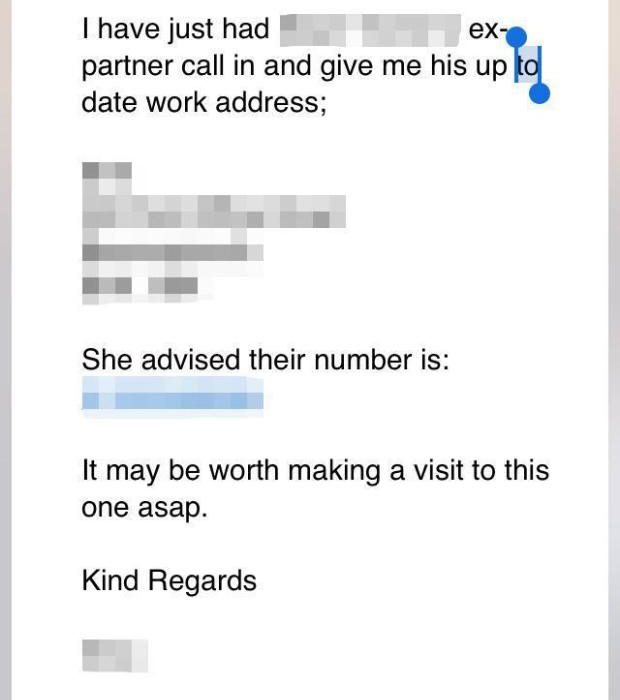

The email, seen by The Sun Online, says the customer's ex-partner has "just called in" and has given his work address and phone number.

"It may be worth creating a trip to this one asap," the client service agent adds.

On its website MobileMoney says it's the UK's first "logbook lender" being set-up in 1998.

Logbook loans are loans secured against a borrower's vehicle.

Customers can lend between lb500 and lb25,000 in an APR rate of up to 189.9 percent.

That means a borrowing taking out a lb1,000 loan over 18 months will end up repaying lb2,094.

While a person who took out a loan with a leading bank for the similar of money within the equivalent time would pay lb1,106 – at a rate of 13.9 per cent.

Mr Middleton said he took a lb1,000 loan in April in order to pay for repairs to his van that they needs for work but has been struggling to meet the repayments of lb135 a month.

In total he states he'll payback more than lb2,000.

"It had been way too simple to acquire one to be honest," he explained.

"I went on the web site and put in my car registration and employment status and they rang me straight back."