As a small business owner, you may have a well-run organization which generates a very healthy profit. But to actually take your company to that particular next level of success you'll need a business loan to purchase equipment, inventory, employees, technology, working capital, and so forth.

With a good business, obtaining a loan ought to be simple, right?

The the fact is – it depends.

It depends on several factors, most of which incorporate your personal credit rating, industry, amount of time in business, annual revenue. And based on in which you obtain a loan, whether a traditional bank or an alternative lender, there could be a lot more factors.

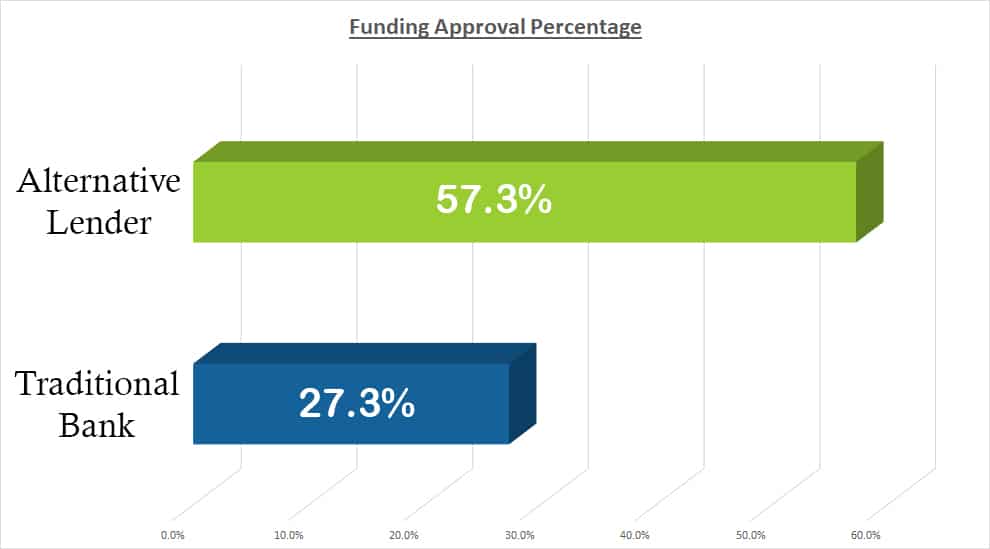

Tradition banks approve only 27.7% of smaller businesses for a financial loan. The main reasons could they be consider small businesses high-risk and their ROI may not be as strong.

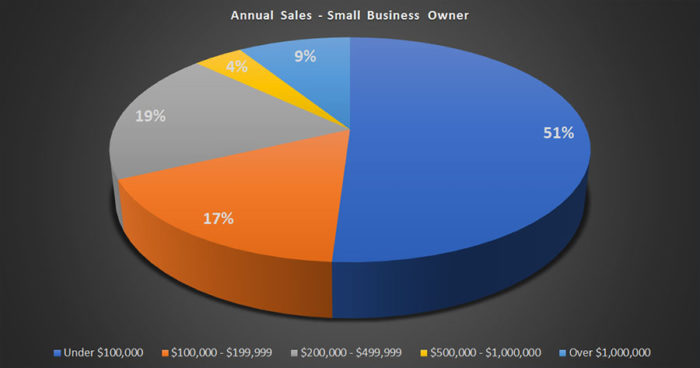

Many lenders possess a minimum revenue dependence on a minimum of $100,000. The absolute minimum threshold is needed to ensure the business owner is generating enough money to pay back the loan. According to businessknowhow.com, 51% of small businesses have annual sales of under $100,000. So until your company is on track to generate $100,000 annual revenue, you'll most likely be declined for funding.

So whether you understand it or not, as a small business owner looking to grow your business with funding, you may encounter several challenges. But you will find steps you can take today to improve your likelihood of getting a business loan.

1 – Get the credit rating in check

The minimum credit score needed to be eligible for a a business loan will vary by lender. But on average a bank will need at least a 675 whereas an alternate lender may need a 500. Nevertheless the lower your credit rating, the larger your chances of getting declined.

And if you're approved the loan amount and terms may be less desirable then if you had a great or excellent credit rating.

Getting your credit score under control prior to trying to get a company loan is important. There are many ways to improve your credit score, but some methods take longer then others. Here are the 3 that could have the quickest positive effect on your score. Improving these will increase your chances of obtaining a business loan.

Check Your Credit Reports

In 2018, only 36% of individuals obtained and also viewed their credit report. Not only should you understand what your credit rating is, however, you also needs to know what’s on your report. Look over your credit reports to ascertain if you will find any errors or whatever you need to dispute.

Pay Down Any Current Personal Loans

Your credit-to-debt ratio must be under 30%, when you exceed time it starts to negatively impact your FICO score.

To determine your credit-to-debt score you need to divide your overall borrowing limit (the credit available to you from the bank or charge card company) and divide this number by what you still owe.

So prior to applying for any company loans, make sure you reduce any credit related bills to get your ratio below 30%. This will help improve your credit score.

Remove Late Items With Credit Bureau

If you have any late items on your report, you can ask the creditor to remove them with credit agency.

However, this will only work for those who have a recent history of making on-time payments. The creditor won’t work with you if you have any recent late payments.

Also remember that its not all creditor will adhere to your request but it’s well worth the phone call.

2 – Don’t get multiple quotes from multiple lenders

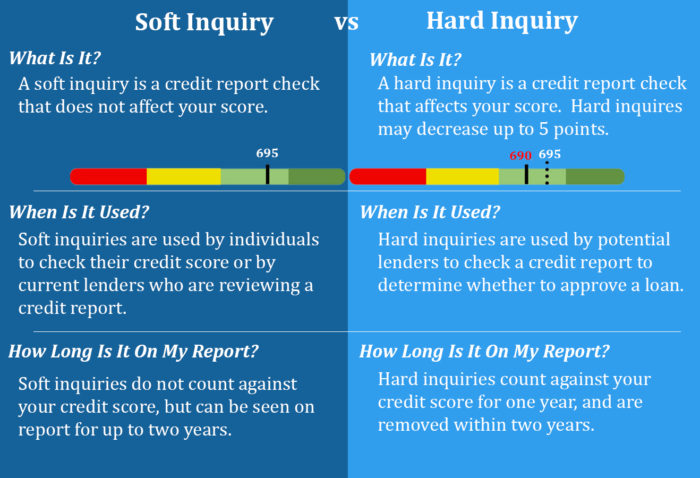

Getting multiple quotes from different lenders sounds like a logical plan. But if you don’t have perfect credit, this can be more damaging to your credit score then it’s worth. The reason being is some lenders will run a hard inquiry of the credit.

A hard inquiry is really a credit history make sure that affects your score. This type of check may negatively impact your score by 5 points with each hard inquiry.

It’s not saying that you can’t get multiple quotes but be cautious the way you go about this. Before moving forward having a lender, always inquire if they plan on a “Soft Inquiry” or “Hard Inquiry” to check on your credit score.

Having a hard inquiry check on your report is not bad and could be needed at some point in the funding process. It’s the multiple hard inquiries that are bad. To safeguard your credit rating, it should be run once after you’ve made the decision which company you intend on going for a loan.

Your best choice would be to get in touch with a lender who'll work with multiple partners for you.

3 – Reduce negative balance days

Consistent income is a key in getting approved for a business loan. Lenders don’t want to see inconsistency in your balance sheet. This represents a risk.

To a lender, income represents an image of the companies’ financial ability to repay financing. Basically, are you bringing in enough money to pay for your present cost obligations, as well as the price of the new loan.

If you have any negative balance days within the time period a conventional bank is viewing your company account, you'll most likely be declined for a financial loan.

An alternative lender is a touch more forgiving. However, if you are average more than 3 – 5 negative days per month, you will have a more difficult time getting approved for funding.

So before you apply for funding, be sure you have a more consistent cash flow.

4 – Choose the right lender

Not all lenders have a similar requirements or funding options. And not all lenders have your own interest in mind. So your research when deciding which lender would be the best fit for the business.

Compile a summary of potential banks and alternative lenders. After that narrow your research by researching what other companies have said concerning the lender. Most lenders should have an evaluation section on their website. Otherwise, you can see if companies have commented around the Better Business Bureau, TrustPilot, or Google Reviews.

From there, see what funding options each has to offer and the minimum requirements.

Understand whatever you decide and qualify for, this helps focus your list on lenders you’ll have a better chance of getting approved. For example, if you have a credit score of 600, you almost certainly will not get approved via a bank. So narrow your jot down to alternative lenders.

5 – Create a perfectly written business plan

If you choose to obtain a business loan from the bank then you'll have to craft a perfectly written business plan why you'll need the borrowed funds. Banks need to see that you’ve considered the reason why you need the money and just how this money will help your company grow.

In your plan be sure you have the following components:

Executive Summary

An executive summary is really a brief review of your company. It should highlight what you would like to achieve, how to make it happen, why the funding is needed, and how it will help.

The executive summary will be the very first thing a bank reads, so make certain it grabs their attention and entices these to go through the entire business plan

Company Description

Provide a history of your organization and where you intend on being in 3 – 5 years. Let you know that your company’s service or product meets the requirements of your customer.

Market Analysis

Describe your industry, target market, and competitors.

Organization and Management Structure

Show an organizational chart. Who's the dog owner and what's their background.

Your products or services offering

Describe your product line or service offering. The way it supplies a requirement for your customer. How it’s different from your competitors. Do you know the current and future opportunities and challenges?

Marketing Plan/Sales Strategy

Explain how you currently or intend to market or sell your product and/or service.

Funding Request

List just how much funding you need and just how it will be used.

Financial Projections

There are 3 main forecasts within this section:

- Cash Flow

- Profits and Loses

- Balance Sheet

6 – Be open to alternative funding options

You stand a larger chance of getting approved for any business loan or any other funding option with an alternative lender.

So why would the approval percentage between a bank and alternative lender be so different.

Simple, it must use risk.

A bank isn't willing to take as great of a risk as a substitute lender. So they set up the requirements to remove a company they determine to be a higher risk.

Here are a few of the differences from a traditional bank and alternative lender

- Credit Score: Bank = minimum 675 vs Alternative Lender = minimum 500

- Time running a business: Bank = 2 Years vs Alternative Lender = 6 Months

- Collateral: Bank = Yes vs Alternative Lender = No (unless using Equipment Financing option)

- Business Plan: Bank = Yes vs Alternative Lender = No