If you have a small business or startup, it's not hard to use your personal credit card for some, possibly even all, of the business expenses. It's convenient. You curently have credit cards and it is often on you.

You might even feel it's your only option in order to keep your business.

In fact, many entrepreneurs started their company by putting their business expenses on their own personal charge cards. And they've just maintained by doing this to do business.

Advantages-

1 – Rewards, Rewards, Rewards

The main benefit most business people will state is:

“I get rewards for each dollar I spend”

If spent enough each month, you begin accumulating points for travel, hotels, and funds back.

2 – Consumer Protections

In 2009, the U.S. Congress passed the Credit Card Accountability, Responsibility, and Disclosure Act (also known as CARD Act of 2009). This bill was designed to protect consumers from unfair practices by the credit card companies.

The main advantages of this act is it prevents charge card providers from charging high fees and/or increasing rates of interest. So other specifics of the balance is credit card providers must:

- Notify you if you are going to exceed your credit limit. There's still a charge for going over your limit, however, you will know get the option to exceed your limit

- Statements should be mailed at least A 3 week period before the deadline.

- The disclosures tend to be more transparent.

Disadvantages-

1 – Hurt Your individual Credit Score

Putting any a number of your company expenses may ultimately wind up hurting your individual credit rating.

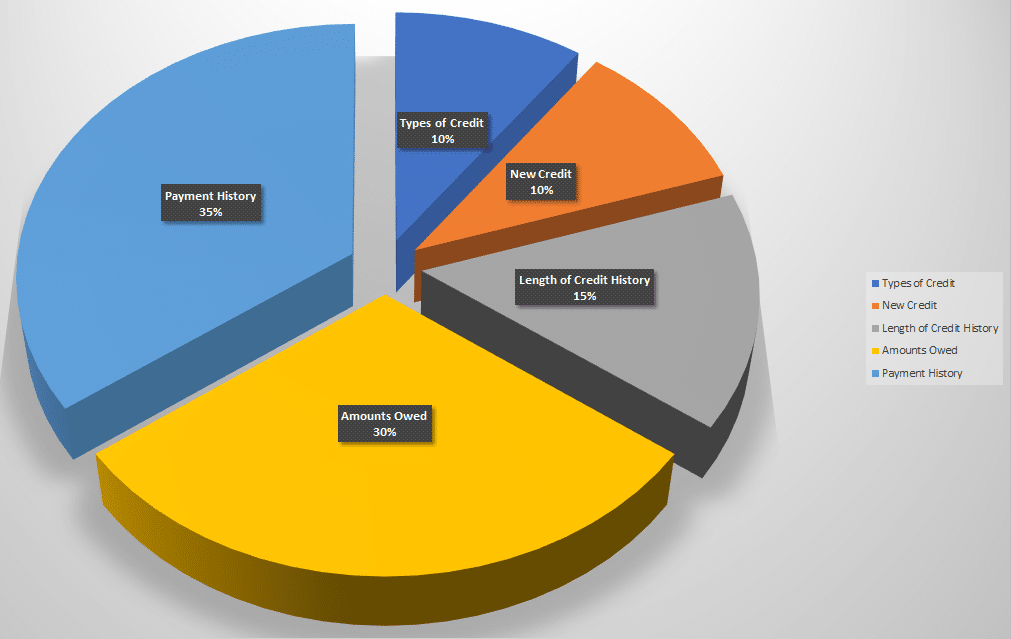

Obviously paying late, defaulting on your charge card will damage your score. These would be the most important factors in managing your credit score. As they have a 35% affect on your score.

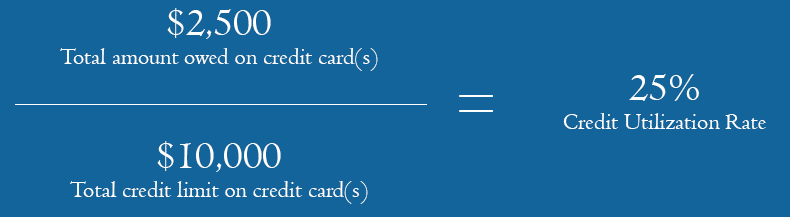

But an area business owners are usually unaware of that can have a major impact on your credit score is your credit to debt ratio, also referred to as credit utilization.

This just is actually the second most important part in determining your credit rating. Exceeding a 30% credit utilization potentially could decrease your credit score.

Determining your credit utilization is straightforward, just divide your overall balance by your borrowing limit.

Keep in mind that your credit score is calculated based on the newest information posted on your credit history. So despite the fact that at the end of the month you may reduce your bill to be below 30% threshold, this can not matter if your credit report operates in the center of a billing cycle.

Here would be the factors that go into determining your credit score:

2 – Spending Limit

As your company grows, so will your expenses. Your credit card limit may range anywhere between $5,000 and $15,000. These factors rely on your credit rating, income, and debt.

If you have a borrowing limit of $15,000, then really you can comfortably put $5,000 in business and personal expenses a month without exceeding the 30% credit utilization.

Eventually this just won't be enough to operate your business.

3 – Won't Build Business Credit

Your personal credit activity is reported towards the credit bureaus. Whereas your company activity is reported to the business credit bureaus.

Similar for your personal credit rating, a company credit score can be used by most business lenders to predict your company's ability to pay your bills in a timely manner.

Eventually you're going to wish to improve this score. This allows lenders to consider a closer inspection at your business performance and skill to pay for bills when determining the probability of providing your company with a loan.

Other companies for you to do business with may look at your business credit score. If this score is low, they might not sell you products or service necessary for the success of your company.

4 – IRS Audit

Mixing your business and personal expenses may draw the interest from the IRS. If your company gets audited, you will need to prove to the satisfaction of the IRS which expenses where business vs personal.

Failure to do this might have you facing serious penalties.

5 – It Can “Pierce The organization Veil”

What does “Piercing The Corporate Veil” mean?

It is typical to structure your business as a LLC (Limited Liability Corporation), S-Corporation, or C-Corporation. One from the rules under these structures would be to keep the personal and business finances separate.

Usually a corporation is treated like a separate entity that is solely accountable for its debts and credits. However, whenever you commingle your individual and business expenses, for example on the charge card and fail to keep proper records, the courts could rule that you're a single entity.

In the situation of the business liability, your personal assets could be at stack.

Don't lose your business legal protection, make certain your company and personal expenses are separate.

Summary-

The dangers of making use of your personal credit card for business expenses far outweigh the advantages. The risks are just too ideal for your business and private assets.

By not putting business expenses in your credit card, you might actually enhance your personal credit score by cutting your credit utilization. This can help you get a business loan having a rate plan later on.

If you'll need funding now, in order to cover those expenses your were wearing your credit card, you will find options. You look into a business credit card and/or a working capital advance.