COMPLAINTS about consumer credit, including payday loans, have risen with a whopping 80 per cent in the first six months of the season compared to the previous six months.

According to new data from complaints body the Financial Ombudsman Service, it received almost 29,500 gripes about consumer credit products between January and June 2023.

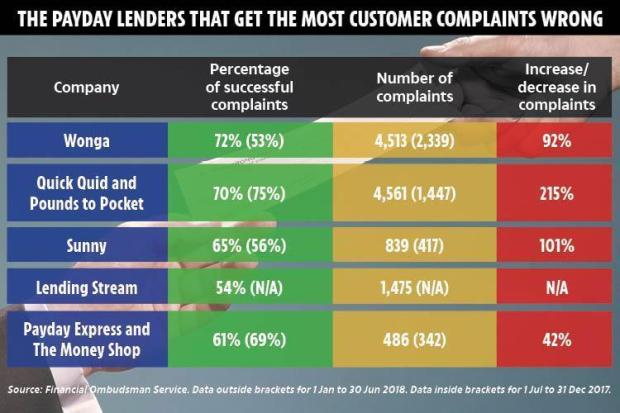

WDFC – which traded as the now defunct payday lender Wonga – was the company with the worst record.

In the very first six month of the year, the Ombudsman upheld nearly three in four complaints (72 per cent) about Wonga towards consumers.

The quantity of complaints about the lender also nearly doubled over the same time period from 2,339 to 4,513.

Wonga continues to be processing thousands of compensation claims from borrowers accusing it of irresponsibly lending, targeting vulnerable customers and charging sky-high interest in 2023.

It was these compensation claims that ultimately result in Wonga falling into administration last month.

The Sun has contacted Wonga's administrator, Grant Thornton, for any response. It would only inform us: "The Joint Administrators of, WDFC UK Limited, confirm that they are working closely using the Financial Conduct Authority (FCA) to aid all customers where possible throughout the administration.

"As part of their statutory obligations, the Administrators will assess all complaints during the course of the administration so it is essential that customers who believe that they have been treated unfairly and therefore are owed some cash, submit their complaint.

"Customers can submit complaints in the first instance by email to [email protected]. Normal service continues to be available with the contact centre on 0207 138 8330. Customers whose complaints are upheld will become unsecured creditors of WDFC UK Limited (in administration).

"Given that the assets of WDFC UK Limited haven't yet been sold and all claims reviewed, the Administrators cannot quantify the amounts which might be available to unsecured creditors or even the timescale for such payments.

"However, the Administrators do encourage customers who feel that they are owed some money to make contact with Wonga using the above email address to register their complaint so the monies that are offered to unsecured creditors can be fairly allocated to agreed claimants."

When you are looking at wrongly coping with complaints, Casheuronet, which trades as Quick Quid and Pounds to Pocket, was the payday lender which gets the next most quantity of complaints wrong.

The Ombudsman upheld seven in 10 (70 percent) customer complaints about the lender, which unlike Wonga is still trading.

The provider also saw an impressive 215 per rise in complaints, rising from 1,447 within the last 6 months of 2023 to 4,561 within the first half this year.

Sunny, which is the trading name of Elevate Credit International, Lending Stream, the trading name of Gain Credit, and also the Money Shop, that is a trading name of Express Finance (Bromley Ltd) are all still in operation.

But Payday Express, which is also an investing name of Express Finance (Bromley Ltd), is no longer offering loans to new clients – existing customers need to continue repaying their loans normally though.

For a lot of Wonga, take a look at our guide on has got the loan firm collapsed, who owns it and just how would you claim compensation?

Payday lenders have been slammed for dragging their heels over mis-selling payouts.

Research finds that cash-strapped NHS workers are the biggest users of payday loans.