BORROWERS are now being warned that they're going to end up paying HUNDREDS more for a financial loan because they're not given the advertised interest rate.

Banks only have to give approximately half (51 percent) of accepted applicants the rate that they apply for on the loan or charge card.

And typically, these rates is going to be provided to those with the very best credit ratings.

But new research from Shawbrook Bank and the Centre for Economics and Business Research (CEBR) has found that this quirk in the rules often see some borrowers charged up to 150 percent more.

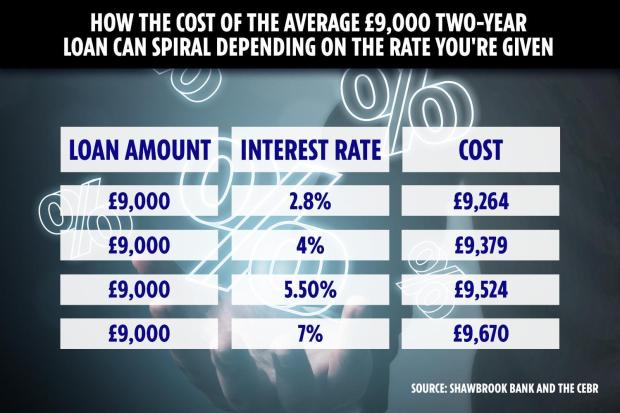

It took the typical loan size of lb9,000 over 2 yrs and located that recently, advertised rates ranged from 2.8 per cent to five.5 percent.

This means that within the term of the loan, you'd repay between lb9,264 and lb9,524 – that's the initial loan repaid, plus interest.

In comparison, the average rate people typically pay across all loan types is 7 percent.

Apply this towards the same two-year lb9,000 loan, and the borrower repays lb9,670 in total.

That's 150 per cent more than the lowest advertised rate, as well as an extra lb406 in interest within the term from the loan, with total repayments costing lb9,670.

This so-called "poverty premium" often sees those found on lower incomes paying higher prices for the same products or services as those who earn more.

Whether it's charge cards, energy bills or insurance, all too often, people who earn the least seem to end up getting the worst deal.

Paul Went, md of consumer at Shawbrook Bank, said: “The gap between consumers' expectation and reality when it comes to the cost of unsecured loans remains fuelled through the practice of 'teaser pricing'.

"The possible lack of transparency surrounding the loan application process isn't just confusing with a consumers however in some instances could be costing them money."

Mr Went adds that borrowers ought to be conscious that applying for financing and then being rejected could damage their likelihood of getting further loans.

He said: "Before you apply, borrowers should be aware that if their application is not successful the price of taking out financing with another provider could rise.

"If you make numerous loan requests in a short period of time you'll probably damage your score and miss out on the very best rates that accurately reflect your credit profile.”

To reduce this risk, use a pre-eligibility checker, for example MoneySavingExpert.com's personal bank loan tool, to check on how likely it is you'll qualify for a loan.

This performs a "soft check" that doesn't hit your credit rating.

We've rounded-up cheap unsecured loans starting from 2.8 percent on borrowing of up to lb10,000.

Just last month M&S Bank launched a high rate 2.8 per cent lb7,500 personal loan.

Meanwhile, we've exposed how payday loan broker Quick Loans, which charges up to 1,575 per cent interest, wants individuals to visit PRISON for getting into debt.