for youWhen a business needs a new device you've numerous sources for financing. That is if your credit is good. Business owners having a low FICO score (three-digit number based on your credit reports that lenders use to determine what you can do to make payments) will be viewed as risky. Resulting in a difficult time getting funding for your equipment.

Your options will be limited when seeking equipment financing with bad credit, but you will have options.

Being in a position to purchase that equipment is essential to your business. Often times the need for a brand new device is mandatory for your business to outlive or it is imperative in order to obtain more business and land large contracts.

What is Equipment Financing

Equipment financing is a type of funding for business owners where you stand given a lump sump of cash for the sole purpose of investing in a device.

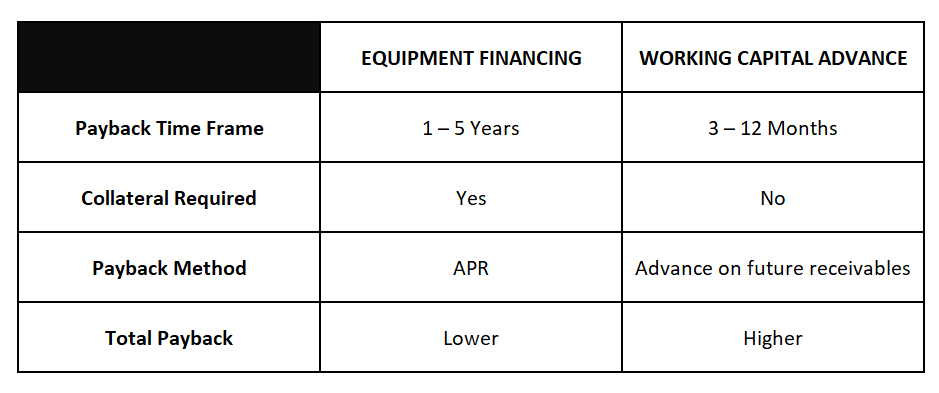

The main distinction between equipment financing and other kinds of funding options, like a Working Capital Advance or Term Loan, is that it's strictly for financing an actual asset. This physical asset will serve as collateral. If you were to default on your financial obligation, the lender can repossess the asset.

Qualifications for Equipment Financing with Bad Credit

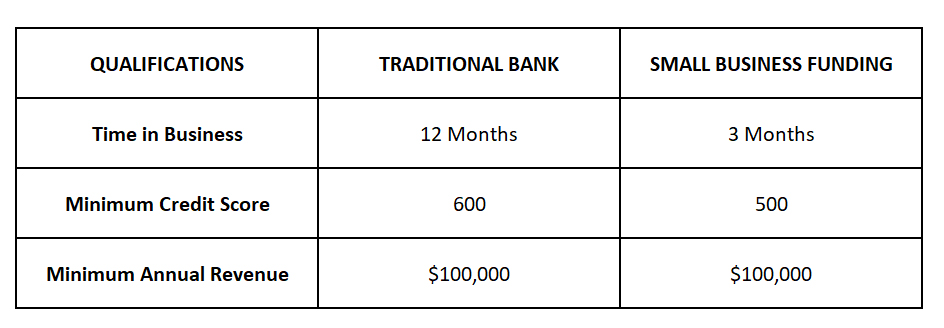

The qualification for equipment financing will be different by lender but based on our research, most lender's qualifications are similar.

Here is a comparison from a traditional bank and Small company Funding.

Outside of those qualifications, an extended business good reputation for making your payments on time and achieving a steady cash flow can help your odds of getting approved despite a minimal personal credit score.

How Does Poor credit Affect Equipment Financing?

Since the physical asset purchased using the equipment financing is going to be used as collateral, it'll make it slightly simpler for you to obtain approved.

Why?

Because the lending company can invariably repossess the equipment in the event you fail to make a payment.

Where having bad credit does affect you with regards to equipment financing is by using the eye rate. You will likely possess a higher APR than someone with perfect credit. To put that in perspective the annual percentage rate for equipment financing could range anywhere between 8.0% and 30.0%.

Where to obtain Equipment Financing with Bad Credit

The manufacturer or business you're acquiring the equipment themselves may have a credit option. Otherwise a bank or alternative lender can offer capital for that equipment purchase.

Whether your seeking restaurant equipment financing, farm equipment financing for poor credit, or any other industry specific financing, your bank or perhaps an alternative lender may be able to enable you to get the required funding.

The amount you qualify for and the interest rate applied is determined by the need for the gear you aim to purchase and many other variables such as industry, credit, etc.

Other Poor credit Funding Choices for Equipment

If you get declined for equipment financing with poor credit, the best choice will be to consider a functional Capital Advance or Merchant Cash loan.

Both these choices are similar. They are not financing within the traditional sense, instead they are an advance of money on future receivables.

A cash advance might be used to purchase your equipment.

The benefit of funding could they be may be easier for you to qualify with no collateral is required.

The disadvantages compared to equipment financing are your term will be much shorter, payback typically ranges between 3 to 12 months and also the repayment amount is going to be higher.

How to Apply for Bad Credit Equipment Financing

Applying for equipment financing is simple.

You can use with your local bank or even the bank in which you possess a business account.

Or you are able to apply online by having an alternative lender such as Small company Funding.

With Small company Funding you can complete our online business funding request form or call one of our Funding Managers at 800-742-2995 to go over your options.