BORROWERS in their overdraft might find the fees they pay shaken as new rules enter into force next month – here's what's happening and just how it affects you.

From April 6, banks is going to be banned from charging rip-off unarranged overdraft fees, although they can still charge rates of interest.

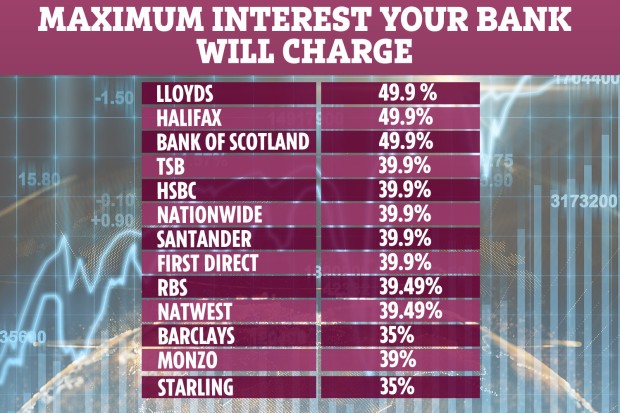

This has seen the majority of major banks and building societies reveal they'll proceed to a 39.9 per cent interest rate – however, many charges you around as 49.9 per cent.

And while seven in ten – or 18.2million people – will be better off as a result, city watchdog the Financial Conduct Authority (FCA) says, what this means is around 7.8million will be in a worse position.

With some banks introducing the changes sooner, we've rounded-up what you ought to know.

What's my bank doing?

Lenders currently charge between lb2 to lb30 a month to have an arranged overdraft, while unarranged fees can be much higher – up to lb6 a day or lb80 a month, which can add up to hundreds of pounds.

But as outlined within the table above, from a minimum of April 6, banks must charge a flat-rate interest for both arranged and unarranged overdrafts, and most have chosen between 35 percent and 49.9 percent.

There are a few exceptions though – Lloyds Banking Group, which includes Bank of Scotland, Halifax, and Lloyds Bank, as well as Monzo and Starling took it a step further by introducing so-called "risk-based" pricing.

This will see Lloyds charge 27.5 percent for most Club account holders, 39.9 per cent for many some other clients, while those with a bad credit score scores along with a good reputation for defaults pays a much higher 49.9 per cent.

When it comes to digital bank Monzo, it'll introduce three interest rates based on your credit score – 19 percent, 29 percent, and 39 per cent.

While Starling will do exactly the same, charging 15 per cent, 25 % or 35 per cent.

How can I find out what I'll pay?

Banks must have written to any or all existing customers notifying them from the overdraft rate changes.

If you don't think you've been told, look at your bank's website or call its customer services team to learn more.

What if I can't afford the new charges?

Banks happen to be warned by the FCA to assist customers with large overdraft debt.

It suggests banks and building societies waive or reduce interest or continue overdrafts in the current rate where people are struggling.

Alternatively, they could set up a repayment schedule that may include moving borrowers to more desirable products, such as unsecured loans which will have in all probability much lower rates of interest.

If you're struggling, speak to your provider as soon as possible to discuss your choices.

You may also be thinking about getting an interest-free cash transfer charge card to settle the overdraft, which means you wind up owing the card instead.

The idea is that you simply then repay the card prior to the 0 percent period ends and you're charged interest.

Check out guide regarding how to shift debts onto 0 percent balance and cash transfer cards and use a pre-eligibility checking tool to determine what cards you're apt to be accepted for before applying.

This reduces the chance of your credit rating being dented by rejections and multiple applications.

Been unfairly charged? You may be in a position to claim the money back

If you've been hit by excessive overdraft charges and been pushed further into debt consequently, you may be capable of getting reimbursement from your bank.

While there are no rules that guarantee this, watchdog guidelines state that banks possess a responsibility to treat you fairly.

Bank of Scotland repaid gambling addict Leon Ray lb2,516 in overdraft fees after The Sun complained on his behalf.

You can complain about charges that occurred dating back to six years ago, whether or not the account has since been closed.

Plus, it's liberated to submit a claim yourself – email your bank first, and when that doesn't work or else you don't get a response within 8 weeks, take your case towards the free Financial Ombudsman Service.

Here's all you need to learn about once again experiencing overdraft fees.