A strategic loan for your small company can make all the difference in helping it become more profitable. Whether you're looking to expand your property options to make room for the growing business, increase the speed and quality of services through new equipment, or bolster your inventory for any busy season, a loan could make which happen.

But where is a good option to obtain a business loan? With the strict standards of banks these days, it can be hard to obtain the loan you need for a price you really can afford.

While trying to get loans from the bank could be a long and sophisticated process, we believe you should still be able to find the perfect services to suit your needs. This is exactly why Small Business Funding offers more flexible loan options with much faster approvals so you can get the money you ought to get your business profitable now.

In the meantime, that will help you with some from the latest and greatest information all around the best banks for small company loans, we've compiled a list of reliable banks that may be in a position to help you get the loan you need.

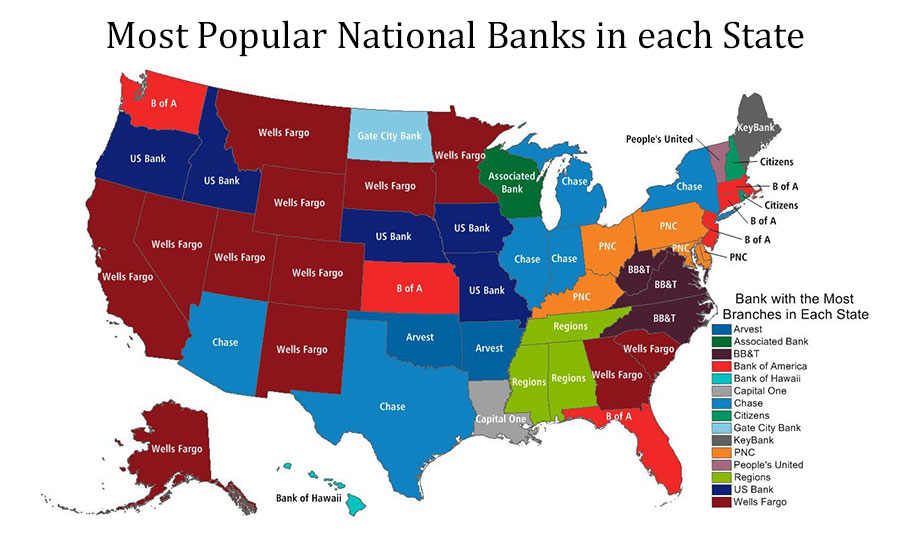

National Banks

Each national bank you can use is chartered through the U.S. national government and is a part of its Fed System. They've been integral banking institutions since very in early stages within our country's history and continue to provide the public with use of banking services with everything from personal checking accounts to mortgages and loans.

When you work with a national bank, you'll usually have the benefit of a multitude of services and access to physical bank services all over the nation for simple transactions and account handling.

While big national banks often have the disadvantage of rigid systems and a 'one size fits all' mentality when it comes to customer support, you may still find reliable loans from what we should consider some of the best places to get a small company loan.

Wells Fargo

Likely one of the most well-known names within the national banking industry, Wells Fargo has been around business for over 160 years. Its reliable reputation during that time originates from its survival through the Great Depression and also the storied good and the bad from the U.S. market through history. With all of this history, however, you can still rely on new innovations and versatile business solutions when it comes to small business loans.

Wells Fargo continues to be through it all, in the initiation of drive-up tellers to automated teller machines an internet-based banking to provide customers a streamlined, convenient service.

US Bank

Not unlike Wells Fargo, US bank includes a history that goes all the way back to 1863. Following a number of mergers when the Twenty-first century hit, the financial institution took on the name of U.S. bank and established itself in Minnesota. Ever since then, it's turned out to be among the five largest banks in the U.S.

As a result, you can expect probably the most diverse and intensive services when it comes to corporate and commercial banking for clients. Using the consistent, predictable and repeatable processes you may expect from US Bank, they're one of the best banks for small company loans.

JPMorgan Chase

Another business that's seen a lot of history (over Two centuries, in fact), JPMorgan Chase & Co. has its own roots in Nyc. It began having a number of heritage firms that significantly led to financial innovations over the U.S., one of these was, surprisingly enough, assisting to finance the Brooklyn Bridge.

Since that time, JPMorgan Chase has grown its presence in over 100 markets and be one of the biggest leaders in investment banking, which includes commercial and small businesses along with its regular consumers.

Capital One

Another big named within the banking industry, Capital One is possibly best known for its take on innovative banking designs. Mr. Fairbank has served because the president of Capital One and helped lead the organization since 1995, taking it from the start-up venture and into among the ten largest banks in the country.

A reliable banking partner, Capital You have a pursuit to help clients succeed through ingenuitive, simple banking practices that focus on bringing an element of humanity and creativity to business. With no lack of financial services and resources for aspiring entrepreneurs, Capital The first is among the best places to get a small company loan.

Bank of America

Bank of America services approximately 66 million consumers and small company clients across the nation, which makes it a worldwide leader in regions of wealth management, investment banking, and servicing an array of asset classes. Today, Bank of the usa remains dedicated to responsible growth, whether which means dealing with smaller businesses or even the environment in particular.

The leadership you can find at Bank of the usa for reliable growth and accountability, causes it to be among the best banks for small company loans. By having an emphasis on community and empowering individuals toward financial success, you will probably find the services you'll need.

TD Bank

A largely New england focused bank, TD Bank's roots go completely back to 1852 in Portland, Maine. Similar to other big bank histories, it gained its current identity through merges that brought together significant financial resources and services to provide loans and banking services for purchasers and businesses alike.

It remains among the ten largest banks in the usa while offering an extensive array of services to retail, small business and commercial clients searching for reliable service.

If you would like both convenient and varied options for financing your online business, TD Bank is really a difficult option to go wrong with.

Live Oak Bank

With its laser focus on business innovation and opportunities, Live Oak Bank is among the easiest banks to get a small business loan from. As a powerful financial provider, Live Oak Bank offers speed by looking into making loan decisions quickly, transparency in letting you know where you stand in the application process, and immediate access in your terms to provide quality communication.

Like any other great bank, you may also expect convenience and security to service your small business's needs. When you use Live Oak Bank, you can develop a working relationship that provides you loan terms your business can thrive on.

Huntington National Bank

Another pillar within the small company community with regards to federally backed banking, Huntington National Bank has been servicing customers since 1866. Having a focus on the Midwestern part of the U.S. Huntington National Bank has been serving communities to build up smaller businesses with smart financial investments.

With $59 billion in assets, the bank doesn't have shortage of financial resources to provide the clients approved to utilize them. Huntington National Bank continues to be focused on smaller businesses and middle market ventures with more than 160,000 commercial relationships, so they offer both services and experience you need to grow your small company.

The Neffs National Bank

A more locally centered national bank, The Neffs National Bank started its banking services in 1923. It remains focused on the neighborhood community like a one-bank holding company and continues to provide both customers and small local businesses with the banking services and loans they need to succeed financially.

Whether you are looking for a commercial account without any minimum balance or monthly service fees or commercial loans that cover equipment, capital, lines of credit and much more, The Neffs National Bank can present you with the little business banking services you need.

Chase Bank

Chase Bank is really a division of JP Morgan Chase & Co. so large that it claims to serve up to 50 % the nation. In terms of your online business banking, this means you'll easily be serviced almost anyplace in the US, whether you'll need ATM and funds services or time by having an employee face-to-face to barter a small company loan.

Another advantage of the bank's dimensions are its purchase of technology, which offers the best on the internet and mobile banking services for utmost security and convenience. Chase Bank readily offers small business loans to customers who qualify, so that they may be the perfect option for prospective owners.

Axos Bank

Though much newer towards the financial space than most traditional banks, Axos Bank is continuing to grow its assets to in excess of $11.8 billion.

They also differentiate themselves through their technology: Axos was founded as a digital bank in 2000 and still remains a web-based banking service its its customers today. This makes it uniquely flexible in the offerings nationwide, which can be also extremely competitive because of the lack of maintaining a lot of physical locations. All that extra cash adopts improving their digital services, which also include small business loans.

M&T Bank

M&T Bank has its own roots in Ny as far back as 1856. That reliability is backed by $120 billion assets it has built up through the years, making it another large and flexible resource when you want all the business banking options you can get.

When you bank with M&T bank, you can get corporate loans, credit lines, checking and many other services. In addition to being a powerful bank to service customer needs, M&T Bank is also rated among the best small company lenders to help companies grow.

BBVA

BBVA is another big bank that's unique in the global footprint. By having an focus on different and innovative business practices, the financial institution has been around operation since 1964 and has only grown ever since then.

Besides offering traditional small company services like loans and checking accounts, BBVA goes one step further to supply merchant services and specialty programs meant to help small businesses obtain access to the funds and services they need to be profitable.

The Honesdale National Bank

The Honesdale National Bank also provides a far more local flavor for purchasers in the Eastern U.S. Founded in 1836, the bank has offered full-service community banking for many years and was named among the “100 Highest Performing Community Banks” by Alex Sheshunoff and The Partnership for Banking Excellence.

With an emphasis on growing the community, small business owners seeking great rates on loans and services may find an excellent partner within the Honesdale National Bank.

Whether you're dealing with commercial mortgages, equipment leasing programs or business charge cards, The Honesdale National Bank has that covered and more.

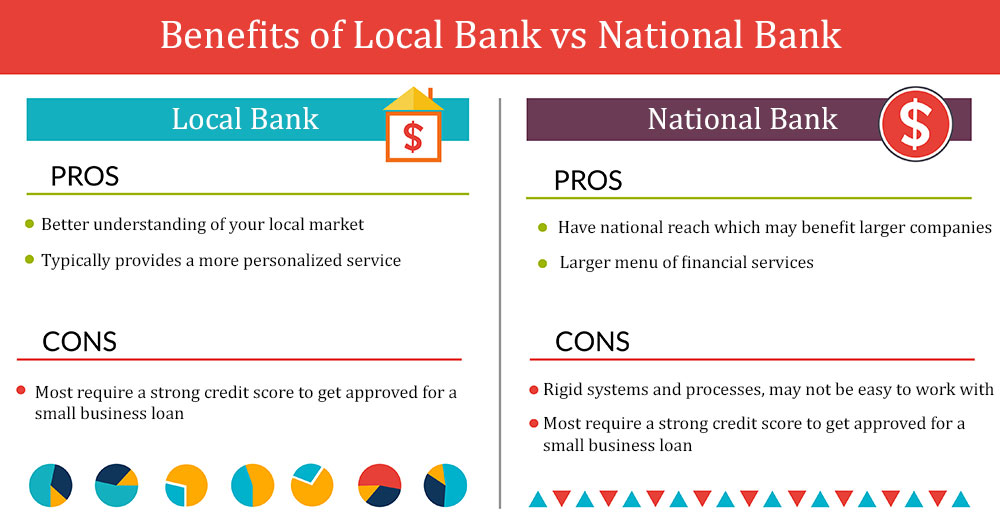

What Local Banks Can Offer

Local banks can be a great choice for smaller businesses looking for loans and services to help them thrive. Though they are certainly small compared to massive national financial institutions, community and native banks often offer more competitive rates on their loans and services.

Their checking accounts for businesses and consumers are often free, as well as their knowledge of local businesses and markets could make them more forgiving when you apply for small business loans.

The service of local banks can also provide more personalized services for loan applications where one can have direct conversations with loan officers and managers to get the services you'll need for your small company.

Be sure to check the local banks around your area to locate competitive rates for business services.

The Best Place to get a Business Loan

While banks are a solid choice for your company loan needs, they are able to still be difficult to get funding as a result of numerous reasons.

If you are not locally established, do not have ideal credit, or find it difficult to demonstrate a consistent income for your start up business, it may be extremely difficult to obtain a loan, much less one with a good rate.

At Small Business Funding, we're dedicated to providing services for small businesses from all types of different markets and circumstances.

If you want to get premium financing services to boost the profitability of your business, you can apply with us today by calling 800-742-2995 or completing our online business funding request form. See the way we will help you.