The Free Application for Federal Student Aid (FAFSA) is required by most colleges and universities to be able to determine financial aid eligibility. It is also used to calculate federal student education loans.

Do I Need to Fill Out FAFSA Even when I Don’t Be eligible for a Educational funding?

You might be asking yourself “Do I have to fill out the FAFSA even if I don’t be eligible for a educational funding?” and also the answer is-it depends.

The forms that come combined with the college admissions process could be overwhelming. You will find college applications, scholarship applications, loan applications, and not to say educational funding forms.

If you’re an upper-middle class family, your EFC (Expected Family Contribution) may be excessive to be eligible for a need-based aid at any of the schools your student is considering.

So, if you’re likely to be paying for college without counting on need-based educational funding, you may be thinking do I really need to fill out FAFSA, right?

(By the way, this question comes up at least one time each day within our PayingForCollege101 Facebook group.)

Here are some commonly asked questions about if you should fill out the FAFSA even though you don't expect to be eligible for a need-based aid:

- Why should I complete FAFSA?

- Is FAFSA required?

- Do I have to complete FAFSA every year?

Why Should I Complete FAFSA?

Many families who don’t fill out the FAFSA just assume they won’t get educational funding but that’s not always the case.

Families are often poor judges of their own financial aid neediness, there are a lot of factors which go into determining EFC and want.

You don't know the way your actual finances will rival the price of the college your son or daughter is targeting.

Frankly, college is more expensive than ever, so even if you earn lots of money, you may find you've financial need at specific schools, which can help you be eligible for a aid.

It all depends on how a college gives out aid and where your EFC is relative to a school’s financial aid policy.

Until you’ve done the study to know what percent of monetary require a college meets and the way your EFC compares to the college’s price of attendance, don’t eliminate completing FAFSA.

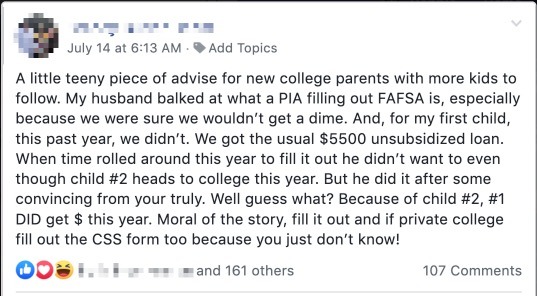

Here’s a pleasant surprise part of our Paying For College 101 group shared with us. She was reluctant to complete FAFSA, but see what happened…

Need Federal Student education loans? Fill Out FAFSA

The authorities offers student and parent loans that are not according to financial need and may help your student afford college.

Federal loans have very favorable interest rates and repayment terms, which will help decrease the impact of school debt after graduation.

Any student, regardless of income, who would like to borrow federal student loans (also known as Stafford or Direct student education loans), must fill out the FAFSA to obtain access to these financing options.

In addition, any parent, regardless of income, who would like to borrow the Parent PLUS Loan should also complete the FAFSA.

Another aspect to keep in mind is the fact that unforeseeable financial events can occur as well as your situation may change.

A job loss, a significant injury, or a death in the household could affect your funds anytime while your student is in college.

Having a FAFSA on file can give you a leg up in case your student needs assisted in the future.

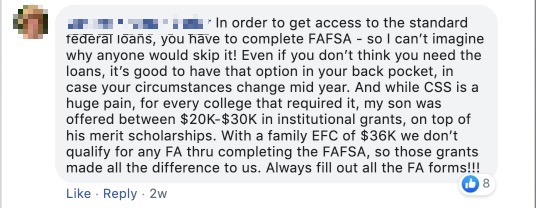

Here’s advice from a person in our Affording university 101 group…

Chasing Merit Aid? FAFSA Might be Required

While policies vary depending on the school, it is possible that the student won't be offered merit aid when they don't fill out a FAFSA.

Sometimes the FAFSA requirement is to verify citizenship or colleges want to make sure a student has maximized their need-based aid before they're awarded merit based aid.

Will having financial need hurt your student's chances of being admitted?

Sometimes yes and sometimes no.

It depends upon the financial aid philosophy of the college.

Colleges are generally considered need-blind or need-aware when it comes to how they consider educational funding as part of their admissions process.

Even with need-aware admission, only students who're around the borderline are influenced by having financial need.

Of course, if you complete a FAFSA and it shows you do not have financial need in the school, then the application won't be affected either way because you won't actually use need-based aid.

Are You Required to Submit a FAFSA?

Filling out FAFSA is not needed to use or attend college. However, if a student and their family doesn’t fill out FAFSA, they won’t have the ability to access any federal funding, grants, Direct Student loans or the Parent Plus loan.

Subsidized and Unsubsidized Direct Student education loans offer students the choice to gain access to federal loans that are within the student name without a cosigner. As an incoming freshman it is very difficult to get a lender prepared to lend money to students with little to no credit history. This is why it’s important for students to think about borrowing Direct Student education loans before every other loan option, and in turn make certain they fill out FAFSA to get access to these loans.

Do I must Complete FAFSA Every Year?

Yes. In case your student wants to be looked at through the college, state, or authorities for financial aid (grants, loans, and scholarships), they need to fill out the FAFSA each year.

In addition, your financial need may change every year. For example:

- Your student may have a one-time scholarship that can help for freshman year, but won't extend into sophomore year or beyond.

- You might have additional children who definitely are starting college.

- Your income might be different, the school's cost may change, your student may transfer, and much more.

Filling out the FAFSA never hurts, and it is not really a difficult process.

Do You Need Help Finding Colleges Offering Merit Aid?

Are you looking to manage your college financial situation by finding a school that's generous with merit aid?

Don't spend hundreds of hours compiling data yourself but still ponder whether you missed something.

Check out our College Insights tool for researching colleges and creating a list of affordable schools that can offer your student merit scholarships.