Did you know that approximately $ 30 million entrepreneurs from the base of small businesses in the usa and supply 7 out of every 10 jobs in america. This really is according to the SBA Office of Advocacy. In fact, over 99% of US businesses could be considered smaller businesses, that is defined as a strong with less than 500 employees.

On average about 627,000 new businesses start every year according to the Small company Association (SBA). Yet sadly not all of those businesses make it their newbie running a business. What are the reasons why small businesses fail?

Before we obtain into the why, let review some business failure statistics.

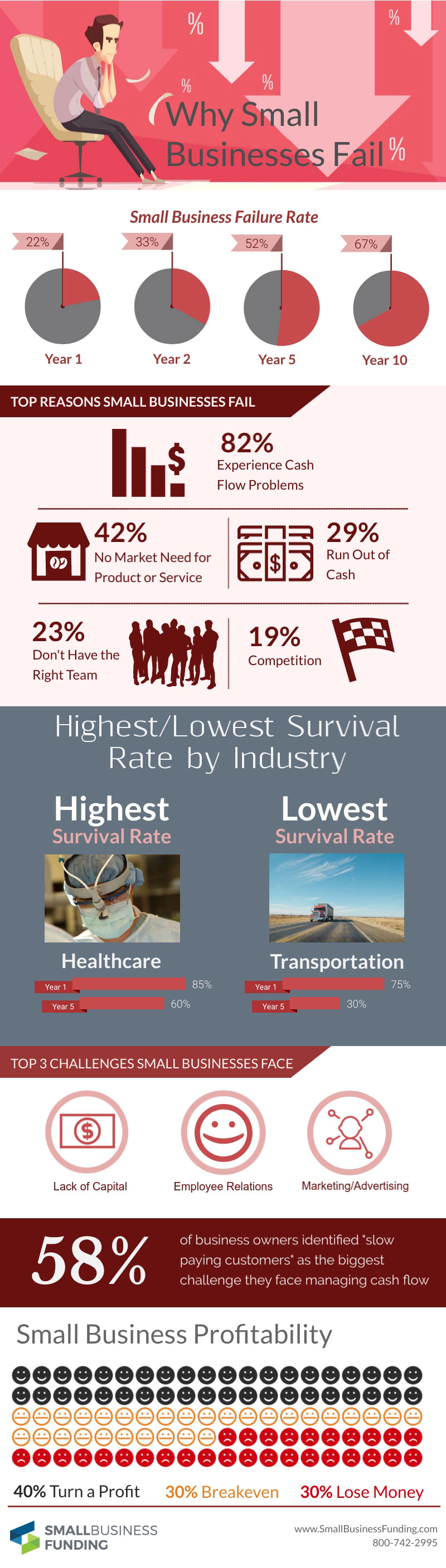

Small Business Failure Rate / Success Rate

According to the U.S. Bls, 21.7% of startup businesses fail their first year of operation. Less than 50% survive year 5 and just another of businesses make it 10 years.

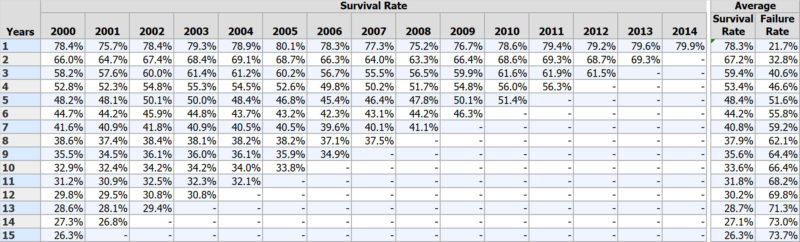

The data below comes from the U.S. Bureau at work Statistic. It shows how many new businesses survived through the years. Each year the number of surviving companies is fairly consistent.

Which Small company has the Highest Survival Rate

The Healthcare and Social Assistance industries succeed the most from any company. 85% of recent businesses in Healthcare and Social Assistance will be closed after their first year in business. This is greater than the overall average of 78.3% survival rate for those small businesses. And through 5 years the rate of success is still high at 60%

Which Small company has got the Lowest Survival Rate

The Transportation market is the most difficult to interrupt into. The survival rate in the first year of operation is only 60%. And time drops to 30% success through 5 years. So 70% of transportation startups won't be around after their fifth year.

Why Small Businesses Fail Infographic

Reasons Why Smaller businesses Fail

There are loads of reasons why small businesses fail, ideas focus on the top 5.

Cash Flow Problems

To start let's be clear, cash flow is not the same as profits. You could have a very profitable business but if you don't have a strong income, you are able to go under. Cash flow is the cash received minus your cash out. It's what you offer to pay for your financial obligations.

Problems occur when you're awaiting payment from the product or service but you've bills which need to be paid.

No Market Need

A common miscalculation that a new business owner makes is assuming there's a need for your products or services. Or they fail to help the market know how their product/service offer will make their life better. This is why market research is important to both new and existing businesses.

Run from Cash

Running shattered, as opposed to insufficient income, happens when your account payable are more than your bank account receivables. Basically, you are spending more then you are making.

Don't have the Right Team

A bad employee(s) can negatively impact your business by being a cancer within the workplace, misrepresent your brand, or making mistakes that could affect your bottom line.

Competition

Competition is great for consumers but it may also be great for businesses, if you know how to use it to your advantage. However, if you can't try to differentiate yourself in the competition, you might find yourself too much of economic.

What Makes a Small Business Successful

Now let's review what makes a small business successful. Many businesses owners who survive past the 5 as well as 10-year threshold cite one or more of the following reason for their success:

Customer Service

This sounds obvious but you would be surprised the number of business owners fail to put their customers the main thing on their business decisions.

Focus on Marketing

You have a great product or service, but with no strong online marketing strategy how will your prospective customers understand what you are offering. Eventually you will need to begin making a good investment inside your marketing efforts, but early on there are some low-cost marketing strategies you can implement.

Hire the Top Employees

Just as a bad employee can negatively impact your business, hiring a top employee can catapult your company to new levels of success. So take time to learn how to find and hire the best employees.

How Small company Funding Aids in Small Business Success and Failure Rates

We recognize that small businesses would be the power to develop our economy there are many factors that affect small company success and failure rates. In good times, along with the challenging times, business owners need a fast cash flow solution to make payroll, purchase new equipment, expand inventory, pay taxes, etc.

The average time to break even is 12 to 1 . 5 years. Most small company possess a desire to grow and want guidance and assistance to accomplish this from the lending partner like Small Business Funding. We are linked to the nation's top alternative lenders and may get you use of fast capital no matter time in business, credit score, or type of business. We specialize in high-risk loans.