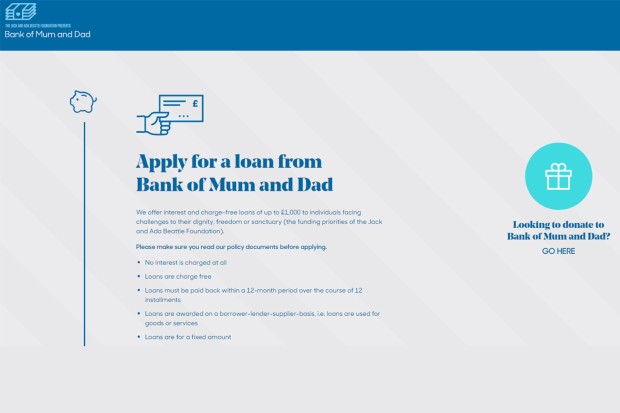

A NEW money borrowing service that brands itself as the “antidote” to extortionate payday loan lenders is offering vulnerable people zero percent interest loans as high as lb1,000.

The Bank of Mum and Dad says it wants to stop rip-off lenders charging unaffordable rates of interest, which could soar to more than 1,500 percent.

To stop people using loan sharks, the lending company lets borrowers make an application for interest-free loans as high as lb1,000 that must be paid back with Twelve months.

Smaller amounts can also be borrowed, however the money can be used to buy or for a service.

To qualify, the applicant must be facing challenges for their “dignity, freedom and sanctuary”.

Borrowers should also provide three months' price of bank statements to prove they can pay back the money, plus they'll need two referees who can vouch for their circumstances.

The loans are awarded on a borrower-lender-supplier basis, which means the lending company must be sure that the borrower are able to afford the repayments.

If a borrower can't manage to pay back the money, the financial institution of Mum and Dad says it may lessen the repayments and boost the lending period, but only in extreme circumstances.

The lender confirmed to The Sun this will also be at an interest-free rate.

The Bank of Mum and Dad was set up by former Labour advertising guru Trevor Beattie, who runs The Jack and Ada Beattie Foundation.

Mr Beattie claims to have place in "a large number of pounds" of his own money to set up the lending service.

But now he is also asking for donations in the public to help fund it, so it becomes self-sufficient.

He told The Sun: "I came up with the concept of The financial institution of Mum and Dad this past year being an antidote to Wonga.

"People, through no fault that belongs to them, end up trapped financially. They get disappointed by the system and need a bit of help.

"I heard someone say recently that it is expensive for be poor because you can't afford to pay it back immediately.

"The sharks begin to own you and also that's ludicrous."

Mr Beattie says he wants the applicants to get "self-satisfaction" from helping others, after they've used the money to help themselves.

He said: "Say you've borrowed lb300, the earlier you pay those funds back, it is going to someone else.

"So then you've attended solving your problem, to helping someone else."

The Bank of Mum and pa isn't a bank and doesn't hand out traditional loans, so that it isn't registered with the FCA.

As it doesn't have a lending licence, your money and then any agreement you sign up to is not protected should it shut down.

How would you affect the financial institution of Mum and pa?

All applications towards the Bank of Mum and pa should be made online – click here for more information.

You can download and fill in the approval, which should be then sent off and away to [email protected].

The application will be individually processed and The Jack and Ada Beattie Foundation decides who receives a loan.

There is no credit check when applying to the financial institution of Mum and pa, therefore it won't affect your credit rating.

Mr Beattie tells us they've handed out around 20 loans so far and claims the acceptance rates are "more than" 50 per cent.

He added that the loans to date happen to be, or are in the process of being, paid back.

Who qualifies for any Bank of Mum and Dad loan?

On its website, the financial institution of Mum and pa says those who qualify should be "facing challenges to their dignity, freedom and sanctuary".

When we put this to Mr Beattie, he explained there are "many cases and examples" that would see someone eligible for financing.

For example, he suggested someone who can't afford to pay their rent due to the five-week Universal Credit wait for new applicants.

Other scenarios include somebody that needs tools to setup a brand new business, or perhaps a parent who needs to buy their child new school shoes.

He went on to describe it as "getting by" money for both employees and those who are unemployed, in addition to vulnerable people who require a temporary boost.

In relation to vulnerable people, this can include, but isn't limited to, individuals suffering an actual or mental illness, or anyone who has just lost their job.

In more lender news, Piggybank entered administration this week leaving thousands of customers in limbo.

The Money Shop and Payday UK have launched pay day loan compensation scheme – are you certainly one of 2million owed cash?

Payday lenders have recently been accused of targeting students heading off to university by offering loans charging as much as 1,294 percent interest.