PAYDAY lenders and brokers are targeting students ahead of the new academic year with short-term loans that charge up to at least one,294 per cent APR interest.

High-cost creditors are preying on those in education who would struggle to be authorized with a traditional high-street lender due to poor credit history or irregular income.

But their sky-high interest rates had the ability to push skint students further into debt.

The Sun found five pay day loan brokers and something payday lender advertising loans to students who either work part-time or are unemployed.

Sara Williams, who runs the Debt Camel blog, has branded nokia's that concentrate on those in education as "disgusting".

She told The sun's rays: "Students have low incomes and little experience of managing money.

"Repaying a loan in the following term will often leave them so short of money that they're going to have to get another loan."

Since 2023, lenders happen to be capped at charging 0.8 percent interest each day but APR includes extra fees for example broker charges and shutting costs.

Interest rates could be not the same as the advertised rates depending on your credit history and circumstances but high-cost creditors charge extra for lending to "riskier" borrowers.

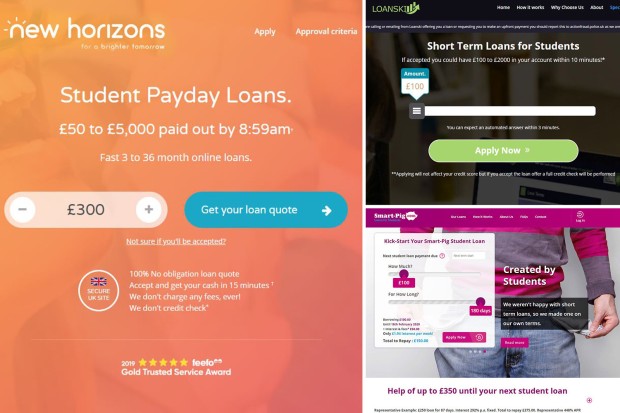

Broker New Horizons has a page on its website focused on pay day loans for students that runs comparisons on regulated payday loan lenders based on 49.9 percent APR.

But it's not before you click on to obtain a quote that you're told that some lenders charge up to 1,294 percent APR.

To put that in perspective, a personal loan from M&S Bank charges 2.9 per cent APR.

Another site that includes a dedicated student page is brokers Payday Pixie, where one can obtain a loan of up to lb1,000 with representative rates of interest of 728.9 per cent APR.

It's an identical case with broker My-Quick Loan that also advocates that students could be accepted with a payday firms as long as they have "some type of income".

Meanwhile, broker Loanski promotes applying for a loan online implies that you "don't need to leave your dorm room", although the APR can stretch to 305.9 per cent, the same rate utilized by OMACL.

Smart-pig.com lends specifically to students, sums as high as lb350 that must be repaid over up to 180 days but in a representative rate of 448 percent.

It's the only firm that caps the interest you pay back at 50 per cent of the amount you borrowed.

Money expert Martyn James from Resolver has slammed the concept of "trapping young adults directly into debt" as "despicable".

He added: "But the banks along with other lenders have to step-up too by providing help for those who are struggling.

"If you're young and have money troubles, don't borrow your way not in debt. Seek help – there's a lot of free assistance available. Don't be afraid to state you're struggling."

New Horizons asserted it doesn't set rates of interest which its website states that students should only seek them "whether they have no other option", and as long as they're affordable.

A spokesperson said: "We don't accept push marketing coercing students into applying for credit.

"Our website includes a page answering numerous questions typically asked by Students searching for credit.

"This page are only found by students who've already made the decision they need use of credit and have searched on the internet or another Search Engine to that effect."

A Smart-pig.com spokesperson said: "Our loans aren't instalment loans, students borrow up until their next education loan date, however, they are able to spend the money for loan back anytime.

"Our loans come with a ten-day grace period, no overtime fees and our customer support team is definitely available to help should students find themselves struggling to repay a loan."

Payday Pixie emphasises it doesn't provide credit products directly.

The Sun has contacted Loanski, My-Quick Loan and OMACL for comment.

Earlier this year, we revealed how loan sharks and payday lenders are targeting places that students live more than others.

Payday lenders have also been preying on hard-up parents and charging 1,333 per cent interest on children's school gear.