BORROWERS are passing up on thousands of pounds worth of payday loan refunds by using claims firms that take a 30 per cent cut of their cash.

Experts say these lenders are "misleading" customers by not which makes it clear you spend for his or her services.

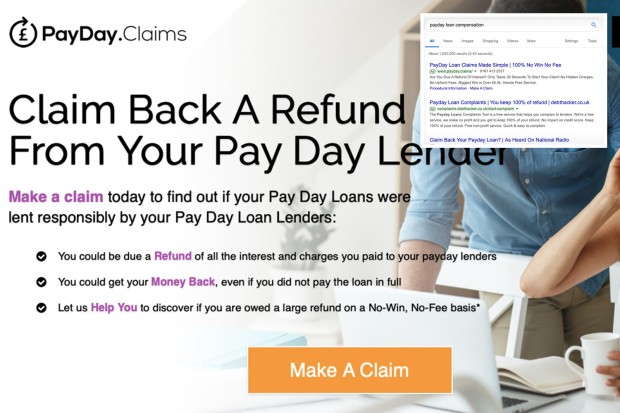

When The Sun checked, two of the four top results on the internet for "pay day loan compensation" were adverts for claims management companies – but neither said in their ads they would impose a fee.

The first ad, which was for a company called Payday.claims, went as far as to state there were "no upfront fees" and "no hidden charges".

But it's only within the terms and conditions from the company's website it says it requires a 25 % fee, and this charge is payable even when cash reclaimed is used to pay down existing debts.

The terms and conditions also lists a host of other fees you'll be charged, together with a lb25 fee for sending emails on your behalf should you cancel the claim before compensation is paid.

Another firm, called Fast Track Reclaim, charges an even heftier 30 per cent of any claim plus VAT – something it again doesn't say in its Google ads.

When clicking right through to the website there's also no information on fees apart from within the terms and conditions of the page where it wrongly says it requires a 24 per cent fee.

It's only when clicking to read the "frequently asked questions" that you simply discover it really charges 30 percent for pay day loan reclaims.

On a lb1,000 payday loan refund, that would be a lb300 slice of your cash it requires.

'It's outrageous'

While firms don't need to include fees within their adverts under the Advertising Standards Authority's (ASA) rules, consumer experts have slammed the ads as "misleading".

Martyn James, consumer expert at online complaints tool Resolver, said: "Promotions for Google could be completely misleading as they often trick you into thinking they'll assist you to free of charge once they don't.

"Claims management companies ask you for huge sums for something you can perform free of charge, so it's outrageous that they'll avoid mentioning their fees in their advertisements.

"It's money for free, so their charges should be upfront."

Sara Williams, a volunteer at charity Citizens Advice who also runs your debt Camel advice blog, added: "Payday loan claims companies charge an extortionate amount for sending an easy email to some lender and then forwarding the complaint towards the Financial Ombudsman Service after 8 weeks.

"Many claims companies also refuse to take strong cases involving loans of six years of age to the Financial Ombudsman Service – they merely wish to deal with the simplest ones in which a simple email works."

"Instead, you will get a simple template to follow along with free of charge online."

The ASA has had action previously where claims firms have listed a sum people could reclaim without having to say a charge wastaken from this.

These firms are presently permitted to charge whatever fees that they like though because the Financial Conduct Authority (FCA) only caps claims management fees at 20 percent for PPI.

But it is considering introducing a cap around the fees firms charge pay day loan borrowers.

When you are looking at Google, the search engine says adverts for payday loan lenders where repayment is due within Two months are banned however it does allow ads for claims managements firms.

A Google spokesperson said: "Because we would like the ads people on Google to be useful and relevant, we've policies that prevent ads for payday loans where repayment arrives within Two months from the date of issue.

"When we discover sites that are breaking this rule, we take appropriate action."

Payday loan mis-selling is very large business, with complaints to the Financial Ombudsman Service rising to 40,000 in 2023, up from 17,000 the year before.

The problem is that many of these financing options were unaffordable and shouldn't have been dished in the initial place – but people don't realise they can reclaim free of charge.

We spoke to one dad who landed a lb3,750 refund for any lb600 pay day loan he couldn't afford.

Blue Panda Finance, the company behind Payday.claims didn't react to our request comment.

A spokesperson for Quickly Finance, which is behind Fasttrackreclaim, said: "The firm entirely complies with all advertising and regulatory requirements regarding its website and advertising campaigns.

"While numerous consumers wish to undertake claims for payday loans and other areas themselves a substantial number would rather instruct a 3rd party to do this on their behalf.

"A customer is unable to progress through the website without agreeing to the conditions and terms which expressly state the charge.

"We think about the fee amount is really a fair amount. Such fees are within the normal parameter of claims management services and also the regulators in this area haven't capped such fees to date."

Payday lenders themselves, charging as much as 306 percent interest, happen to be targeting hard-up Brits in Facebook groups.

And many borrowers are still charged DOUBLE the amount lent.

Plus, we reveal the areas where loan sharks and payday lenders are preying on people – and how to get affordable credit.