TESCO Bank has slashed the speed of its loans for those borrowing lb7,500 or more, which means there are now five lenders offering market-topping rates.

The move by Tesco sees its rate fall from 3 per cent to 2.9 percent.

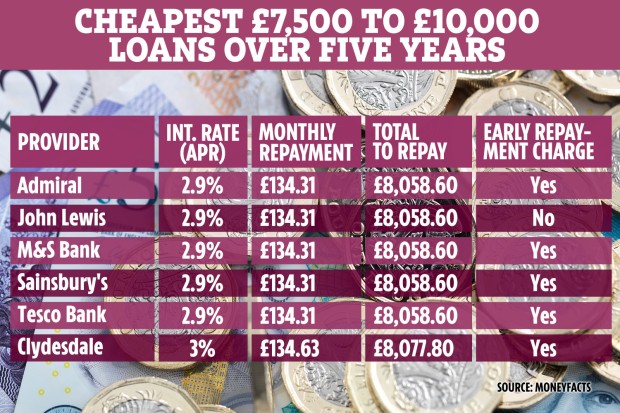

This brings it consistent with Admiral, John Lewis, M&S Bank, and Sainsbury's Bank, that have been already relaxing in the best buy position with their 2.9 percent rates for lb7,500-plus loans.

So remove a lb7,500 loan over five years with these lenders and you'll repay lb8,059 as a whole with monthly repayments of lb134.

On a larger lb10,000 loan, meanwhile, you'd repay lb10,744 in total over five years with monthly repayments of lb179.

The fact a lot of lenders are providing this top rate should mean it ought to be easier for borrowers to locate a cheap loan.

So should you be likely to take out a loan anyway, now could be the time get it done, according to Rachel Springall, personal finance expert at comparison site Moneyfacts.

She said: “Tesco Bank now joins several other providers because the joint-lowest rate for its lb7,500 loan tier.

"Its rate cut comes in the perfect time for any borrowers looking for a loan either to consolidate debts or make home improvements over the summer."

Of course, you should always check just how long the lending company is willing to lend to you before you apply – and also the longer the word the more you'll repay as a whole.

And if you're hoping to make early repayments, do check you won't pay a fee to do this – just the John Lewis loan comes without these fees.

You also needs to always employ an eligibility tool to check on your chances of being accepted for a loan before you apply.

That's if are applying for an excessive amount of credit in a short time frame and you're rejected, it might hurt your credit rating, which in turn could hurt your odds of being accepted with a different lender.

MoneySavingExpert.com includes a handy free tool you should use before applying.

But quote that just 51 percent of successful applicants will be offered the headline rate of interest.

You may be given a significantly higher rate and this will consequently affect just how much you repay in total.

In addition, Ms Springall highlights that borrowers seeking to take out smaller loans might be better off elsewhere.

She said: “It's quite typical for financial institutions to decrease rates for the loan tier close to lb7,500 because this normally the advertised loan rate tier they will use.

"Which means that borrowers searching for a smaller loan might not find rates as appealing."

For example, the cheapest rate on the lb5,000 loan over 3 years is Clydesdale Bank's higher 3.3 percent. But within the term you'd repay lb5,255 with monthly repayments of lb146.

Check out our round-up from the cheapest unsecured loans.

And see our help guide to the cheaper options to high-cost credit that may save you a lot of money.

And if you're searching for the best method to repay debts, we compare balance transfer cards to personal loans.