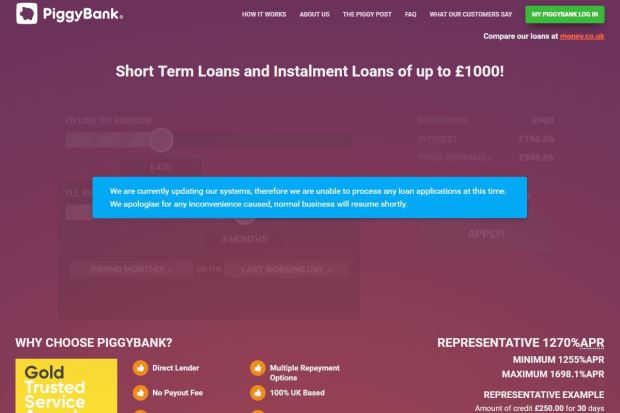

PAYDAY lender PiggyBank has been temporarily banned from providing loans over "concerns" it may be irresponsibly lending.

The city watchdog is investigating the firm's "creditworthiness assessments", which determine whether a customer can afford to get financing.

Typically, high-cost lenders, such as payday loan lenders and rent-to-own firms, give loan to borrowers who are often rejected by those found on the high street due to poor credit history.

But this comes at a price, with lenders charging sky-high interest rates.

It's these rocketing rates that may plunge vulnerable borrowers into debt, leading us to produce our Steer clear of the Credit Rip-Off campaign with these to be limited to double the amount borrowed.

PiggyBank, which has 45,000 customers, replenish to 1,698.1 percent APR for money loans, when compared to 2.9 percent APR charged by a few high street banks.

But the Financial Conduct Authority (FCA) is worried about how thorough PiggyBank's affordability checks actually are.

Responsible lenders are obliged to carry out credit report checks on applicants before providing cash to make sure that they are able to afford the repayments.

The FCA has asked PiggyBank, that is part of company DJS (UK) Limited, to stop lending although it performs its investigation.

There isn't any end date for that review so it's not clear yet when, or if, PiggyBank can begin lending again.

Existing customers are being urged to continue making repayments normally and also to contact the organization with any concerns they have.

They will also be still able to manage their accounts online or by telephone as usual.

At this stage, the watchdog is reviewing the possibility of irresponsible lending, so details on what this might mean for purchasers depends upon the end result, including any potential redress.

A Financial Conduct Authority spokesperson said: "The firm has decided to stop lending to customers and to execute an external review of its lending policies.

"It's important all firms follow our rules, particularly when it comes to affordability and we will do something when we see breaches in our rules."

PiggyBank told The Sun that it has also taken the chance to update its website and back-end systems.

A spokesperson said: "Like a responsible lender, we continuously strive to be the best that people could be and improve our services wherever possible.

"We achieve this by working closely with the FCA at all times and have done this voluntarily."

A huge 5.4million expensive credit loans were removed in the year to June 2023, according to the FCA, up from 4.6million in the same period the year before.

Earlier this season, we revealed how payday loan borrowers are still being charged Double lent for them.

Around the same time, the FCA released data that showed complaints about payday loan lenders soared by a whopping 130 per cent in 2023,