What is a working capital loan?

Working Capital Loans are loans that are removed to finance the day-to-day operations of the business, rather than a financing option which is used to develop a business through acquisition or buy long-term assets. These financing options cover short-term operational needs for example payroll, rent, and debt payments.

These kinds of loans in many cases are utilized in industries which have cyclical sales or seasonal sales. As such they may be cash-rich many months of the season, but cash-lean with the off-season.

Working capital loans in many cases are utilized in these situations to obtain a company through periods of reduced business activity. This is common in retail, but also within the companies supplying those retail outlets. These financing options are usually removed during sparse periods and repaid during the busy season.

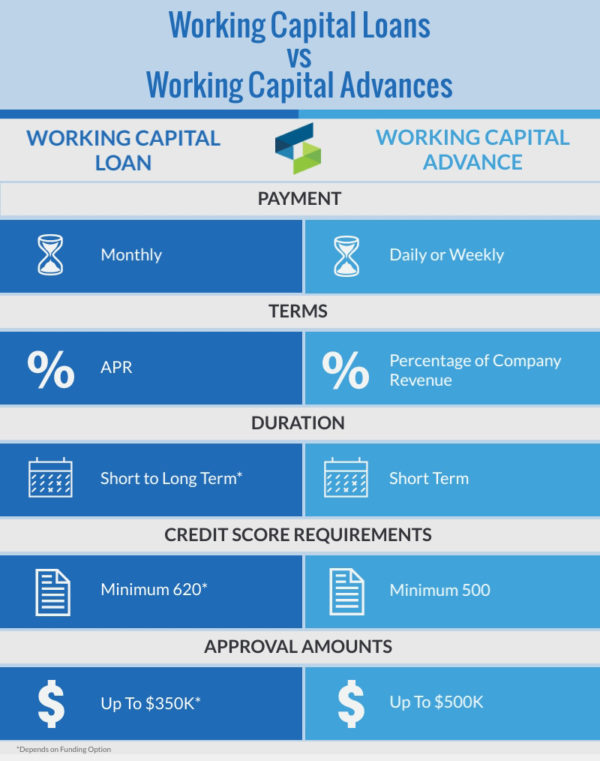

What's the difference from a capital loan along with a capital advance?

A working capital advance (also known as a Business Cash Advance or Merchant Cash Advance) is not considered a loan. It's an coming of cash on your future credit card receivables. Because of this, there is no APR rate with no set repayment terms. There is only a set payback amount. A flat fee will be charged to you for the advance. Generally, these short-term capital advances possess a term of between three and 12 months.

Why can you choose a capital advance?

A capital advance is ideal for a business owner that has had trouble obtaining funding from a traditional bank due to poor personal credit or lack of amount of time in business. A working capital advance places less importance on these 4 elements. However, they're deemed to become a high-risk advance and due to this the price of capital will be higher.

A capital advance can be a great way to finance your holiday inventory, as chances are that you will need cash immediately, and dealing capital advances can get approved quickly. It's not necessary to meet with a manager and assemble all of your business documents in triplicate-and you certainly do not have to wait a month for the bank to get back to you about your approval. Repayments are made either daily or weekly using a business' merchant processor or using a daily ACH debit from you company banking account.

Working capital advances don't affect your business credit limit, either. If the emergency happens, you may still use your credit cards or bank to locate the right path from difficult. These advances don't cap your limit.

Why would you want a working capital loan?

A capital loan might help whenever a company is inside a tight spot and requires funding for brief term goals. It costs less than a capital advance, because better qualifications are needed; a higher credit score, extended period running a business and superior annual revenue. Such a loan also has more standard repayment plans and offers more flexibility when compared with funding.

Working capital is the distinction between your business's current liabilities and assets. Assets may include accounts receivable, inventory, and cash on hand. Liabilities may include accounts payable and any payments on business debts due in the next Twelve months. The SEC defines it this way:

“Working capital may be the money leftover if a company paid its current liabilities (that is, its debts due within one-year of the date of the balance sheet) from the current assets.”

So, for those who have assets worth $300,000 and liabilities of $150,000, your working capital ratio is 2:1.

Working capital loans can leverage that ratio to save you time for short term expenses, such as seasonal work, a downturn, or an emergency. These short-term loans aren't meant to solve all of your problems. They are a stopgap to prevent the problem from getting any worse-and then allow you a pathway to working your way from your debt.

Types of Capital Loans

Short-Term Loans

Because capital is generally used for daily expenses, loans made to help cover those costs will typically have shorter payback terms. Often these financing options are known as cash flow loans and must be repaid within 1 to 3 years.

They're generally not designed to pay for investments like property or equipment.

Business Line of Credit

Even businesses that aren't experiencing any cash flow problems may benefit from the working capital line of credit. This borrowing allows you the flexibleness to consider as much as you need. You are able to repay it as possible. After which borrow from that same source later on while not having to go through the need for completing a new ream of paperwork.

SBA Loans

If you have good credit, you may be in a position to be eligible for a a low-rate SBA (Small Business Administration) loan to help you together with your capital. Since the loans are guaranteed by the SBA, they pose less risk to lenders, causing them to be appealing and affordable.

The catch with SBA loans is the fact that there are a lot of hoops you have to jump right through to acquire one, and it is difficult. In addition to both business and personal credit rating requirements, you have to satisfy other criteria too. The procedure may take as much as 3 months.

Types of Working Capital Advances

Merchant Cash Advances

A merchant cash advance isn't a traditional loan, but it is a way for businesses to access the money they have to make ends meet temporarily. To be eligible for a merchant cash loan, your business must accept credit cards, since the lender requires a number of all of the charge card purchases which are received from your company until the advance pays off. Also, you need to have a credit score with a minimum of 500, been in business not less than 6 months, and also have a monthly revenue of at least $15,000. This is a good source of quick liquidity but could have steep APRs.