Have you usually imagined having your own small business? Perhaps you have finally started doing that which you always wanted to do, but you lost your enthusiasm along the way? It takes place. You will find struggles with budgeting, personal time management, client hunting, and competition, you can easily fall under the pressure. Don't go there!

Before you start considering how hard it's a small business, attempt to get an optimistic perspective: there's always space for growth.

Here are 8 important bits of finance advice for small business owners that will help you conserve a successful business.

Create a realistic budget

If you need a large capital to keep your small company, you should think about downsizing. Rather than focusing your whole energy on the final result, concentrate on the journey. Evaluate your starting place and create a realistic budget that will work for now. Reduce the pricey plans making your idea simpler so you can manage it using the finances you have now.

Yes, you will find investors willing to support small businesses, however, you need to prove your company model is manageable before you can attract them. That's why you have to get realistic with the budgeting. For starters, ignore fancy offices, the costliest computers, and a new car. Spend in the most minimalistic way so that you can maximize the results.

Balance your business goals with your own personal goals

We see this often: small businesses frequently get so consumed by their business goals that they forget all about life in general. They quit all contacts; they do not see their loved ones that much.; they practically don't live away from offices.

You do not want that to occur. You may refer to it as commitment, but it is much more of an addiction which will quickly make you burnout.

Write down your business goals. Plan how you'll achieve them and just how much work you may require there. Then, jot down your personal goals. Those are essential, too. Your contacts, hobbies, interests, loved ones-etc those are the things that make you the individual you're. You lose them, you lose yourself.

Overestimate the expenses

When you're creating a budget, don't make it too tight! Be flexible and plan something extra for each expense you have in mind. This is a easy way prevent unpleasant surprises that will drag your business to a disaster.

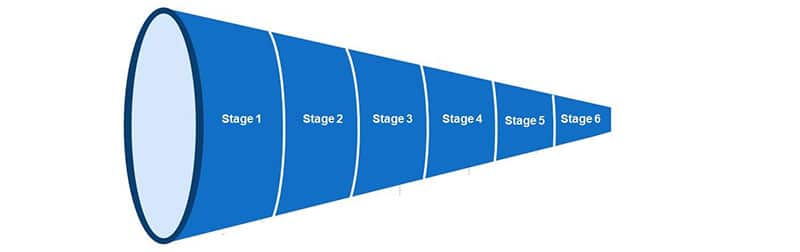

Observe your sales cycle

The sales cycle isn't just an advertising and marketing theory. It's a practice that actually works under most circumstances. It includes seven stages:

- Identifying new potential customers

- Making an offer

- Confirming the potential of a prospect to buy your product or service

- Presenting an offer they cannot refuse

- Answering the prospect's questions and addressing their concerns

- Closing the sale

- Attracting recommendations

Observe how each one of these stages operate in the concept of your company. When you understand them, you'll be able to bring your prospective customers from one stage to another one without losing them somewhere in the middle.

Remember: Time is money too

When you have the ability to reduce the time both you and your team spend at the office but maintain the results you're making, we're referring to productivity.

Do you see that you simply and most of the workers are staying overtime? Which means the workload is larger, and that is the best thing. However, additionally, it means your whole team is exhausted, and that's not a good thing. Consider getting a few more people, so you'll keep up with the same productivity while providing individuals with more time and personal space.

Don't hire so many people too soon

Remember: you need to maintain a realistic budget. New hires mean new expenses and also you absolutely need all of the right people in your team, but don't hire them too soon. Begin with a small team and increase it when you have the current personnel are getting good workload compared to what they could handle within the ideal circumstances. This means they should be doing enough work to justify their payments, but you mustn't place them under a strain with deadlines they couldn't possibly meet.

Find the total amount! When you observe that the workload and workforce are outside that balance, it's time for brand new hires. More workload means your business is making more money so that your budget won't suffer from the new inclusions in the team.

Revisit your financial allowance over and over again

Remember how you started your small business having a precise budget? You have your profit and loss budget, but are you tracking the progress and making the appropriate revisions?

Separate your budget into months for that budget period. Then, evaluate the goals you met and also the expenses you made on a monthly basis. See how they can fit within the big picture. Whenever you observe that situations are not going as planned, you will need to revise some aspects of your financial allowance. If you are experiencing the finances, it's wise to hire a specialist to help you with budgeting.

Ask for discounts!

Do you need desks and chairs for your offices? Are you buying multiple computers at once? Are you employing an online service to take care of the content marketing campaign? Whatever products or services you need for the business, always discover the most cost-effective offer! You need top quality, but you also need to mind your financial allowance.

All businesses are willing to provide you with discounts when you're ready to invest money. You shouldn't be shy and ask for them.

How much potential does your small business have? A lot more than you believe! There's space for every business idea on the market. Your approach, commitment, and enthusiasm will determine the prosperity of your startup.

Adhering to these 8 Helpful Pieces of Finance Advice For Small businesses could scale your business a lot sooner.

AUTHOR BIO

Yassine is a small business operator and co-found of SEO Agency HQ. A firm believer of PLANNING, and loves helping other small businesses thrive. Like a digital marketer, Yassine were able to scale his agency to 6-figures and expand with other small business ventures. “Focus, Plan, Execute, It's That Simple” He states.

Yassine is a small business operator and co-found of SEO Agency HQ. A firm believer of PLANNING, and loves helping other small businesses thrive. Like a digital marketer, Yassine were able to scale his agency to 6-figures and expand with other small business ventures. “Focus, Plan, Execute, It's That Simple” He states.