Owning your personal clients are an entrepreneur’s dream. But with it may come financial pressure running your company. You may be stressing wondering if you’ll have enough cash each month to possess a long-term, successful business.

Improving your money flowing was definitely one of the greatest challenges that entrepreneurs face. There’s nothing worse for than not being able to pay your bills and pursuing the ideal of managing a successful business. Therefore it should come as no surprise that financial pressure is a huge supply of anxiety. This can easily convince one to make unreasonable business decisions.

Many entrepreneurs attempt to prepare themselves by acknowledging that financial stress is a part of the offer. However, letting the sensation to be overly anxious and overwhelmed isn’t exactly healthy. This may lead to serious long-term health consequences. So, you have to find ways to minimize or at best pause its effect on you when you recharge and get ready to work your tail off.

Having a smart plan prior to actually encountering financial problems is a great move to reduce worries and focus on other activities. So we’ve show up with 4 Methods to Avoid Financial Stress When Running a Business:

1 – Come with an Emergency Fund

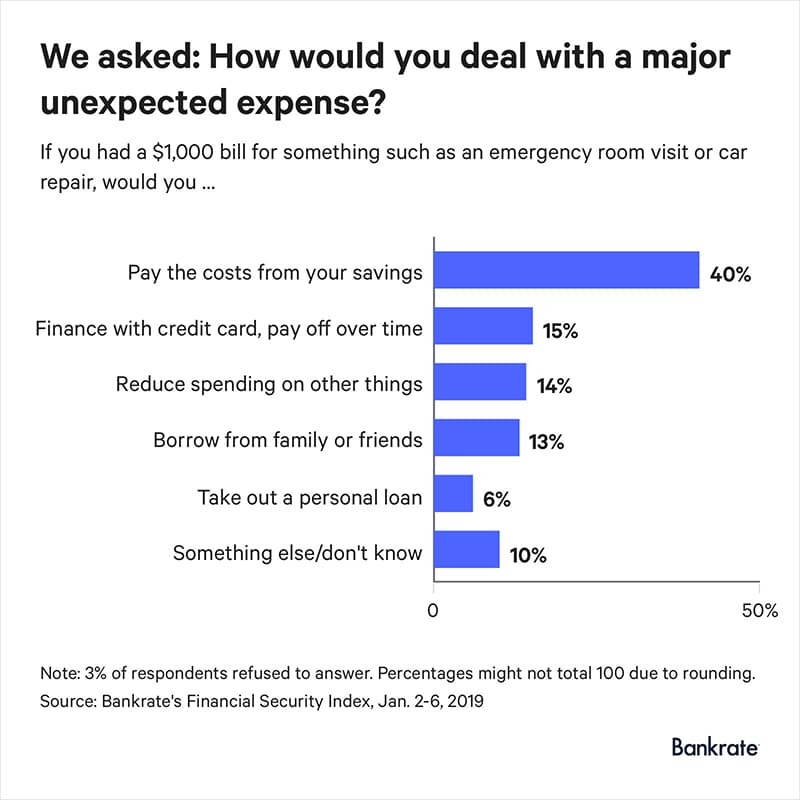

Being inside a bind after missing a single paycheck is something that many people can relate to. For example, a Bankrate survey discovered that only 40 % of U.S. adults have savings to cover an expected $1,000 emergency.

The situation with entrepreneurs may not be very different. However, a lack of an emergency fund when it comes to cash emergency can mean worse things for businesses than individuals. The wages that the business generates may not be predictable and stable. Plus, if for some reason, you go via a bad month, then you’ll need something to remain afloat. Especially, this applies to small , new business organisations that generate virtually no income and need effective finance management skills.

So, since having this type of fund is advisable to lessen financial stress, the easiest way would be to start small. For instance, you are able to:

- Set up automatic withdrawals of some $ 100 into a special savings account

- Look for ways to market your business on the tight budget

- Keep the payroll a little lower until the business takes off

2 – Find Opportunities to Outsource Some Tasks

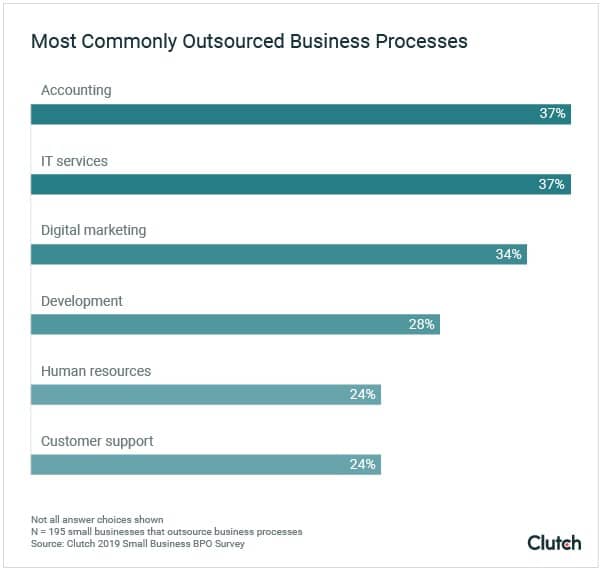

Not only does outsourcing help with finding more time for additional essential things, it reduces the cost of running a business (think the price of recruitment, training, development, benefits, taxes, and so forth). Of course, it contributes to balance sheet, but it allows you to stop working on tasks that either don’t result in business growth or are extremely expensive for handle by internal employees.

A large amount of companies are using this option. For example, 52 percent of small businesses outsource accounting, IT services, and internet marketing tasks, based on a report.

The two explanations why these tasks get outsourced include a insufficient skills to complete them as well as their costs. In so doing, businesses reduce both short-term and long-term expenses, as well as make up for deficiencies in professionals in the initial phases.

Entrepreneurs who agree on the outcome of financial stress use the internet to outsource tasks.

3 – Get Seriously interested in Your Burn Rate

A burn rates are not the speed where you’re losing the motivation to operate. Simply explained, it’s the speed at which your company is spending its budget. For example, if your company’s reserves add up to $500,000 with a monthly spending amount – the burn rate – of $50,000, it will exhaust money in 10 months.

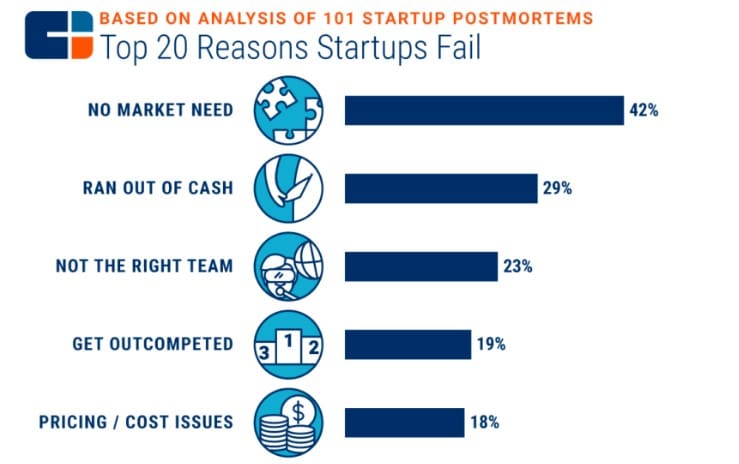

This is something you shouldn’t kid about this, obviously, as running out of funds are in the top 2 reasons why small businesses fail.

Credit: CBInsights

Those businesses that failed were built with a high burn rate. Meaning they depleted their funds supplies considerably faster than they could replenish them. This can lead to more pressure from investors and lots of financial pressure for everybody involved.

Unfortunately, many business people aren’t realistic about their burn rates. Some are overly optimistic – which is a good thing but can hurt sometimes – too confident, or even unacquainted with the real costs. In some instances, they simply don’t comprehend the real costs; they think their business spends about $15,000 per month but really they’re spending at least $17,000.

Well, listed here are two options to go about keeping the burn rate in check:

- Be conscious of the real expenses and understand how and why you’re spending that money

- If your burn rate hits a specific threshold which involves more expenses than originally anticipated, make appropriate planning changes, consider reducing the costs for something, or apply for a business loan

4 – Learn to Unwind by Temporarily Turning Off Work-Related Stuff

As a business owner, you should create a commitment to keep a healthy work-life balance. This will help keep your quality in your life as high as additionally, it can be. That’s in which the capability to completely turn off everything work-related comes in. It can benefit to focus on fun activities, or perhaps rest. This can lead to you being more refreshed and positive consequently.

A large amount of successful entrepreneurs share this idea, too.

“If you’re feeling frustrated or exhausted, one of the best things you can learn to do is rest, rather than quit,” says Sir Richard Branson. “A couple of minutes of downtime can help spur you back into action.”

Better Prepare than Deal as Problems Arise

Financial stress operating a business is something that’s simply inevitable for that majority of entrepreneurs regardless of the industry they operate in. Your best bet is to plan and make preparations. You’ll realize that following the lean startup principles – and managing a pretty tight ship sometimes – is a good method to help your company go through a rough patch.

And, most of all, ensure that you have a support system. Talking to your family or good friends about something that stresses you out at the office can bring that much-needed refreshment and even helpful advice. It’s quite possible that a number of them even experienced the same situation, so understanding their perspectives and decisions might be a wise decision to help you see the problem making smart choices.

AUTHOR BIO

Kristin Savage is definitely an enthusiastic blogger and researcher whose mission would be to help small business owners to make their ventures successful. Starting from her first writing project at Wow Grade, she has authored a great number of detailed accounting, marketing, and talent management articles. Sharing proven tips and evidence-based knowledge is what Kristin does well, so she publishes guides and articles on a regular basis. And also being a cause of some, she also works being an editor at Best Essay Education and Supreme Dissertations.

Kristin Savage is definitely an enthusiastic blogger and researcher whose mission would be to help small business owners to make their ventures successful. Starting from her first writing project at Wow Grade, she has authored a great number of detailed accounting, marketing, and talent management articles. Sharing proven tips and evidence-based knowledge is what Kristin does well, so she publishes guides and articles on a regular basis. And also being a cause of some, she also works being an editor at Best Essay Education and Supreme Dissertations.