BORROWERS are now able to cut the price of their loan by boosting their credit rating with a new personal loan that claims to function as the to begin its kind in the world – but it's not the cheapest available.

The Sun can demonstrate that LiveLend, that is a part of challenger provider Chetwood, has teamed up with credit rating company ClearScore to provide the new loan.

You'll be able to borrow between lb1,000 and lb12,000 from the lender over a 12 to 60 month time frame with rates of interest varying from 9.9 per cent to 36.7 percent based on your circumstances.

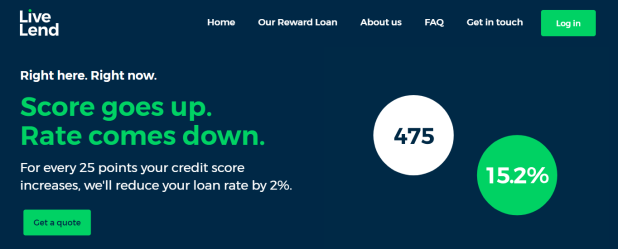

For every 25 points of improvement you are making for your credit rating, you'll see 2 per cent shaved from the rate of interest on a three monthly basis – right down to a floor of 7.9 per cent.

But in case your credit rating goes down, you won't see your interest rate rise.

The lender reckons one in four (25 per cent) of people that remove the borrowed funds might find their rate drop within the first 3 months, with almost half envisioned having their rate slashed after twelve months.

It's hoped the borrowed funds will encourage people to boost their credit score, which will help them to access other lending options later on.

Plus, LiveLend promises to not charge any fees – whether that's to take out the loan, repaying it early or perhaps missing payments.

Julia McColl, head of customer at LiveLend, said: “Many ordinary borrowers don't entitled to the headline rates which are plastered in bank windows.

"You'll be either offered a far worse rate or perhaps be rejected outright.

"So when you're accepted for a loan you're considered the same person for the entire term, often over a long time. Our tech changes this, improving your rate while you improve your score, across the duration of the loan.”

But the loans are unlikely to be the least expensive on the market. Using comparison website MoneyFacts, The sun's rays found the very best rate on a lb1,000 loan for Twelve months, for instance, was just 9.5 percent including the fee.

While a lb12,000 loan over 5 years cost just 2.8 percent. This highlights the necessity to use comparison services to shop around before applying. Check out our help guide to the very best personal loans.

You may even find out which loans you're likely to get before you apply using free online pre-eligibility checkers, such as MoneySavingExpert.com's.

On the new loan, financial expert Andrew Hagger, who runs the MoneyComms financial website said: "It sounds a decent scheme, but my concern is that many people will plump with this without trying mainstream providers and end up paying too much.

"The very best loan rates available on the market should you borrow lb7,500, for example, start at 2.8 cent APR.

"I appreciate that these minute rates are provided to people with perfect credit ratings, but even with a slightly imperfect score you might still get a rate below 10 %."

But Mr Hagger added that individuals should be asked to check their credit rating, which is a strong indicator of whether you'll be able to remove lending options including credit cards and mortgages.

He said: "I think encouraging people to subscribe to their credit rating is good.

"It ought to be mandatory whenever you take out financing, charge card or mortgage – unfortunately too many people don't realise how important it is."

Rachel Springall, an expert at MoneyFacts, added: “It's encouraging to see more innovation within the unsecured loans market that enables borrowers to acquire finance where they might otherwise be rejected, or are forced to use a far more expensive alternative.

"People who may not have probably the most immaculate credit rating will be presented the opportunity to borrow sensibly and be asked to improve their credit score for any cheaper rate simultaneously.

"Unlike a number of other more traditional loans, borrowers can repay your finance early without incurring earlier repayment fees."

“All in most, this will be a great alternative for borrowers who need short-term finance quickly but who also aim to pay off the loan before the end from the term.”

The loan can be obtained from today but be aware that it can simply be requested and managed online.

Millions are closely related payday loan refunds as lenders warned about offering unaffordable loans.

But pay day loan firm Cash Genie recently revealed it won't pay lb20million owed in compensation to customers.