BORROWERS are paying hundreds of pounds extra in loan interest repayments because they do not obtain the advertised rate offered by lenders.

Banks only have to give 51 per cent of accepted applicants the speed that they apply for on a loan or credit card.

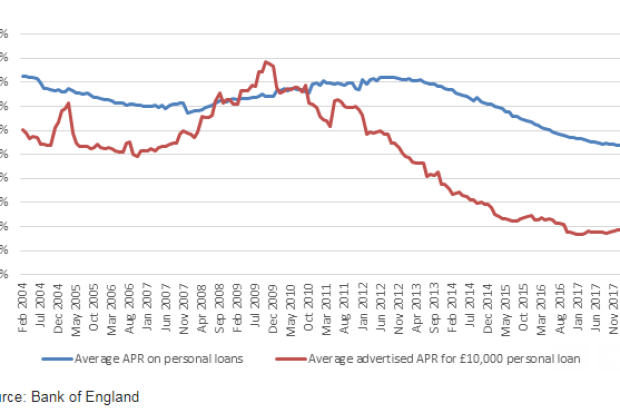

A new report by Shawbrook Bank and also the Centre for Economics and Business Research claims that since 2011 the gap between what banks offer and also the actual rate given to successful applicants has grown from 1 per cent to 4 percent.

The representative or advertised rates are actually just the lowest rate that the minimum number of customer pays.

Customers are often not because of the advertised rate they do not have a good enough credit rating to get the low rate.

But because they are then given a loan with a higher interest rate it could allow it to be tougher for them to pay back the money, which makes it even more difficult to build up the great credit required to get the better advertised rates.

The report found that typically UK borrowers pay 2.4 per cent higher rates of interest than advertised on their loans.

Although the typical advertised interest rate on a personal loan is 4.9 percent, the average rate that is actually being paid by customers is 7.3 percent.

This difference in rate would add an extra lb334 in interest on top of a lb9,000 personal bank loan, for instance.

As borrowers are not aware that they will be receiving these higher rates it might result in customers taking out large loans they think they are able to afford under the advertised rate and then being saddled with extra interest they didn't take into account.

Lenders misleading borrowers with one of these advertised rates has resulted in sixty-six per cent of the 1,500 people surveyed saying that they think dissatisfied using the method in which these lower advertised rates are used to hook customers in.

The amount of credit has risen by lb13billion in the last year, which means that more lenders are using representative rates to market loans.

This has resulted in a widening gap between your advertised rate and also the actual interest rate being paid by customers.

A spokesperson for Shawbrook Bank, who commissioned the report, said: “Shawbrook's view happens to be that 'teaser' minute rates are misleading and we haven't used them as part of our advertising or marketing. "

"However, they have become common practice in the industry and the findings of this report reveal the extent that borrowers are now being unfairly confused and misled by other lenders. "

"We want to take this opportunity to shine a light about this issue and bring it to the attention of the public, which hopefully will lead to a better practice later on."