You may be a successful, profitable business owner. Your business may have a great business credit score, pay creditors promptly, and have didn't have an economic issue with your organization.

Yet go for a business loan in a traditional bank plus they factor in your individual FICO score when determining whether or not to provide your company working capital. If you do not have a good or excellent credit rating you will most likely get turned down by a bank.

It’s not fair but it’s the reality.

We help several businesses looking for funding that have been rejected by a bank due to low personal FICO (a kind of credit rating). They frequently state they run a successful business but their personal FICO is low as a result of divorce, using personal credit to start a business, or perhaps purchasing a home.

Alternative Lenders, for example Small Business Funding, will fund you having a poor credit score for those who have a healthy business. However your terms is going to be higher because of the degree of risk.

Improving your credit score will give you more funding options with better terms.

But how can you start enhancing your score?

Here are 9 methods to raise your credit score – fast:

1 – Make certain Credit history Are Accurate

By law, you are entitled to get a free credit report annually from the 3 main credit reporting companies:

Equifax

Experian

TransUnion

You can request your free reports from annualcreditreport.com.

Once you obtain your reports, take a look at each one of these very carefully to ensure their accuracy. If you see any errors or something that shouldn’t be there, contact the credit reporting company regarding your dispute. Here would be the links to dispute something on your credit history you think is wrong: TransUnion, Equifax, Experian.

You don’t want something you weren't accountable for to negatively affect your credit rating.

2 – Lower your Debt Ratio (Credit Utilization Score)

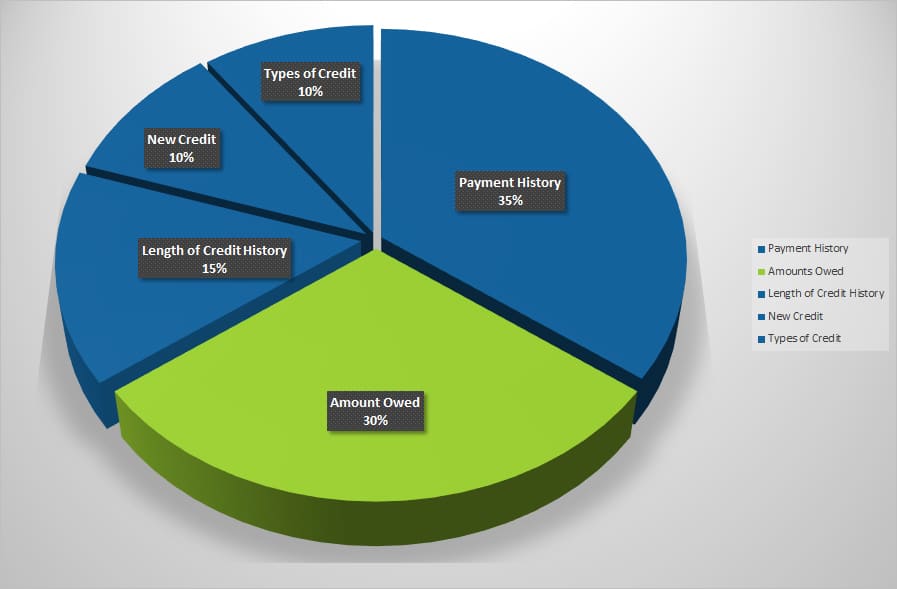

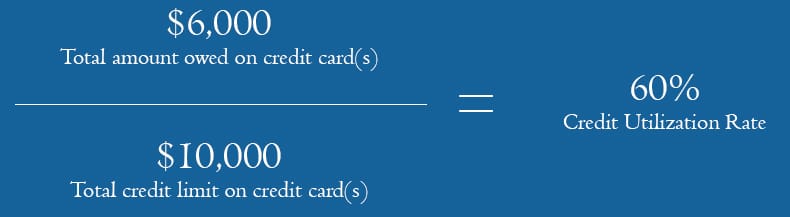

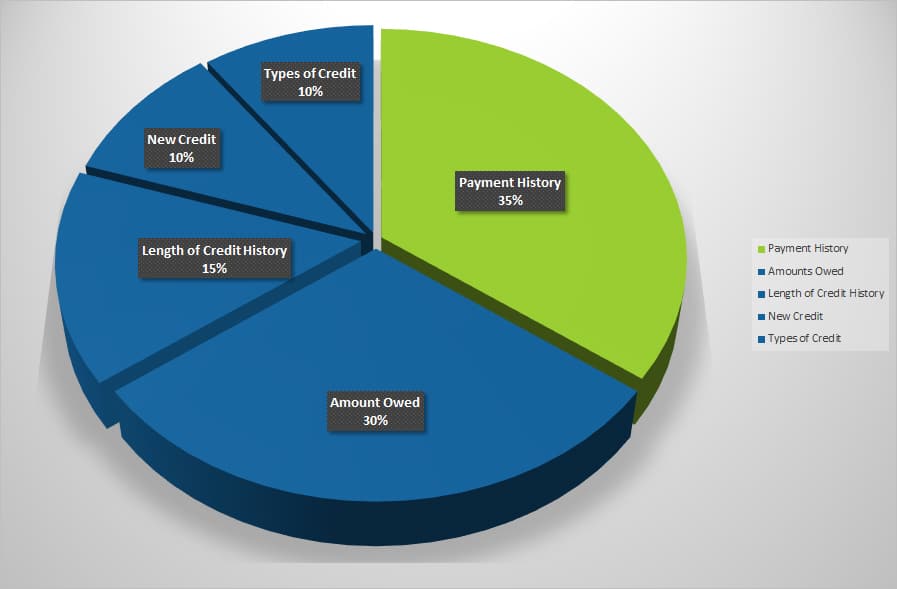

Your credit-to-debt ratio, also referred to as your credit utilization score, impacts your FICO by 30%.

Exceeding a 30% credit utilization score at the time of a credit pull will negatively impact your FICO score.

So what does this suggest?

Your available credit shouldn't exceed your financial troubles by 30%. So, for example, for those who have two charge cards that each possess a $5,000 borrowing limit, you have a total of $10,000 in available credit. Let’s say you put $6,000 of purchases on these 2 charge cards, your credit utilization score is 60%.

At 60%, this can negatively impact your credit score, even though you pay your bill on time and in full every month. A lot is determined by whenever your credit report operates – if it’s immediately after you make a payment as well as your rates are 0%, you will be fine. But when it’s run when you have over $3,000 in debt, it will negatively impact you.

To improve your credit rating utilization score, you've got a handful of options:

1- Manage your financing to ensure you never exceed the 30% credit-to-debt ration

2 – Pay your bills twice a month instead of once

If these options don’t work for you, try:

1 – Request a credit limit, but don’t save money using the increase. The loan increase can help you stay underneath the 30%.

2 – Open a brand new credit card account with a different card provider. The credit utilization score is dependant on your total open credit lines and balances.

3 – Score Boosting Programs

Reach to the primary credit rating agencies regarding a Score Boosting Program. The program enables you to incorperate your other bills such as utility, phone, cable, etc to your credit score in order to demonstrate have a positive payment history.

The two score boosting programs are:

Experian Boost

UltraFICO Score

4 – Get Added Being an Authorized User

Get added being an authorized user on a friend/family members credit card if they make and will continue to make their debts promptly every month. As well as their credit utilization score is going to be below 30%. As a certified user, this account will appear on your credit history.

Before being added being an authorized user, possess the primary account holder ask their charge card company if authorized users are reported to the three major credit rating companies.

5 – Repay what you owe On Time

Paying your bills on time is obvious but it’s worth reinforcing because your payment history is the top element in determining your credit score.

If you have a history of making late payments, now is the time to creating those payments on time.

It’s difficult to say whenever your credit rating will begin improving after months of on-time payments but eventually it will start improving.

6 – Repay Collection Accounts

Do you have an account that’s been delivered to a group agency?

If this account hasn’t been sent to the credit reporting companies, pay it off in full. It will likely be harder to remove from your FICO once it’s been reported.

If the collection account is in your credit history, contact the collection agency and agree to a “pay for delete”. This is where you accept pay your debt in full so long as the company agrees to get rid of the gathering account from your credit report. Give you this in writing with a “pay for delete letter.”

7 – Delete Late Item With Credit Bureau

If you have any late items on your report, you can ask the creditor to delete those late items with credit agency. However you should only do this for those who have a current history of making on-time payments. The creditor won’t work with you if you have recent late payments.

Not every creditor will adhere to your request but it’s well worth the telephone call.

8 – Make BI-Monthly Payments

Making bi-monthly payments won’t directly improve your credit score however the outcomes of that action will.

By paying your credit card twice a monthly you are assisting to improve your chances that the credit utilization score remains under that 30% threshold previously mentioned.

Also, through getting on the schedule where you pay every 14 days or so, you are ensuring that you won't make a overtime.

Those 2 factors will improve your overall FICO.

9 – Limit and Space The Number of Hard Inquiries

If you are looking for a personal loan or business loan, limit the amount of hard inquiries (or pulls) that creditors checks your credit score. Each time a hard inquiry is made, it will reduce your score.

Too many hard inquiries inside a almost no time make it turn to creditors that you're having a hard time obtaining a loan. Also, for each hard inquiry it will drop your score by 5 – 10 points each time.

Some companies, such as Small Business Funding and our network of lenders, will not run a hard inquiry. We will receive multiple business lending offers for you by looking at the health of your business. This kind of credit assessment might be necessary with a few funding options but that will be as we have an initial quote for you personally.

Benefits

Improving your credit score is a challenge that will have a large amount of effort from you. However the benefits are more flexibility. It'll make you susceptible to multiple funding options and better terms for your business.

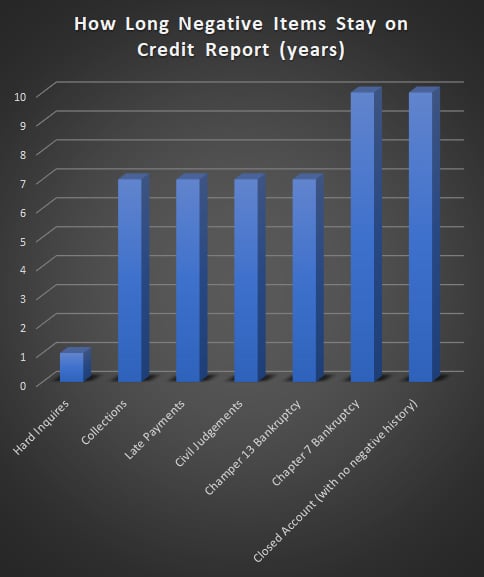

Depending on the damage done to your credit, it might take as much as 10 years to pay off those negative items out of your credit report (see below).

Truth is, based on how low your credit score is, it will take time to improve. There is no overnight fix but as we highlighted above, you can take some quick actions to start improving your credit score today.