BORROWERS looking to take out an unsecured loan to pay for a brand new car, small remodels – in order to consolidate debts – could save themselves thousands of pounds by borrowing an extra lb100.

While you ought to be very careful about borrowing more than you'll need, a peculiar quirk implies that it can work out cheaper to borrow slightly more.

New findings from financial research firm, Defaqto, reveal that in some instances, adding just an extra lb100 to a loan can lead to an enormous drop in the interest rate charged – and massively lessen the overall cost.

As banks aren't permitted to encourage consumers to increase their debt in this way, they don't tell people they can save by borrowing more – even where it might be better for that customer to do so.

Check the rates on offer

If you are thinking about an unsecured loan, you have to carefully examine the interest rates (APR) available.

According towards the analysis from Defaqto, which focuses particularly on the main high street banks, there are three “sweet spots” – the points where a service provider could be cheaper if you borrowed more.

These are usually around lb3,000, lb5,000 and lb7,500.

If you're near a threshold, it will make financial sense to gain access to a bit more.

That said, do not get lured into borrowing a lot more than you are able to reasonably afford. With UK debt levels soaring, it is imperative that you borrow responsibly.

How exactly does this quirk work?

For example, for somebody seeking to borrow around lb5,000, the savings can be very significant.

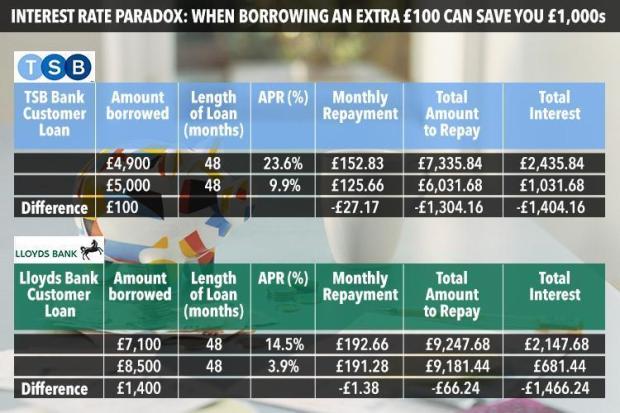

If you took out a loan for lb4,900 from TSB with a rate of 23.6 per cent across 48 monthly payments, this could set you back lb2,435.84 in interest – making a total repayment of lb7,335.84.

But if you were to improve your borrowing by just lb100 to lb5,000, TSB would charge a rate of 9.9 per cent, and also you would pay just lb1,031.68 in interest – making a total repayment of lb6,031.68.

Overall, you would end up paying lb1,404.16 less than if you'd borrowed lb4,900.

With Lloyds Bank, a loan of lb7,100 with a rate of 14.5 percent across 48 monthly payments would set you back approximately the same as a loan of lb8,500 having a rate of three.9 per cent.

As the entire repayment would be just over lb9,180, this would give a saving of lb1,466.24 compared to if you'd borrowed lb7,100.

If you are looking to borrow a smaller amount, and got a lb2,900 loan from Admiral having a rate of 29.9 per cent across 48 monthly repayments, this would cost almost lb25 per month more than a loan for lb3,100 with a rate of 6.7 percent.

The higher amount borrowed would have a total repayment of just over lb3,528, giving a saving of lb1,399.52 compared to if you'd borrowed lb2,900.

Always borrow sensibly

While borrowing a rather higher amount may be tempting, you need to only ever borrow what you can afford to repay.

Brian Brown from Defaqto, says: “You have to do your research and never jump hastily into the first loan you get offered, as with some cases, it may be more cost effective to borrow a rather larger add up to acquire a smaller rate.

"This can lead to your paying less overall. Simply by increasing the amount by lb100, you could save yourself hundreds of pounds.

"But many importantly, consumers should only borrow what they can afford to pay back to avoid getting into financial difficulties.”

If you're looking for a cheap loan then its worth reading our guide on the market-leading rates.