We're all running a business to earn money. Some individuals even have the gumption to step out on that ledge and begin your own company. Over 300 Million individuals will start their own business this season alone

Sadly, the truth is, only 1 from every 10 startups can survive.

The 90% that don't make it fail for various reasons – insufficient strong product, miscalculating the marketplace needs, undertake too much-too fast, pricing, poor marketing. The reasons are endless.

But one area you shouldn't lose site of is the “Cash Flow”

According to CB Insights, who surveyed startup companies that went out of business, 29% of those businesses stated the main reason their company failed was because of “Running Of Cash”. This was the second most given cause of – “No Market Need”.

So how does something similar to this happen?

To explain When i first have to define Profit and Cash Flow.

Profit vs Cash Flow

Profit – is a financial gain, the difference between your amount earned and also the amount spent in buying, operating, or producing something.

Cash Flow – is simply the movement of money in and out of your business

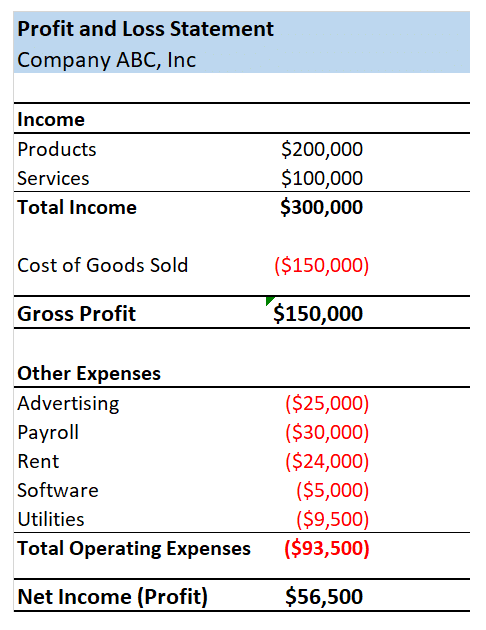

While every business operates to make a profit, here's the catch-22. Let's take the following monthly financial statement example:

A $56,500 profit, sounds great. After all, we are all running a business to create a profit.

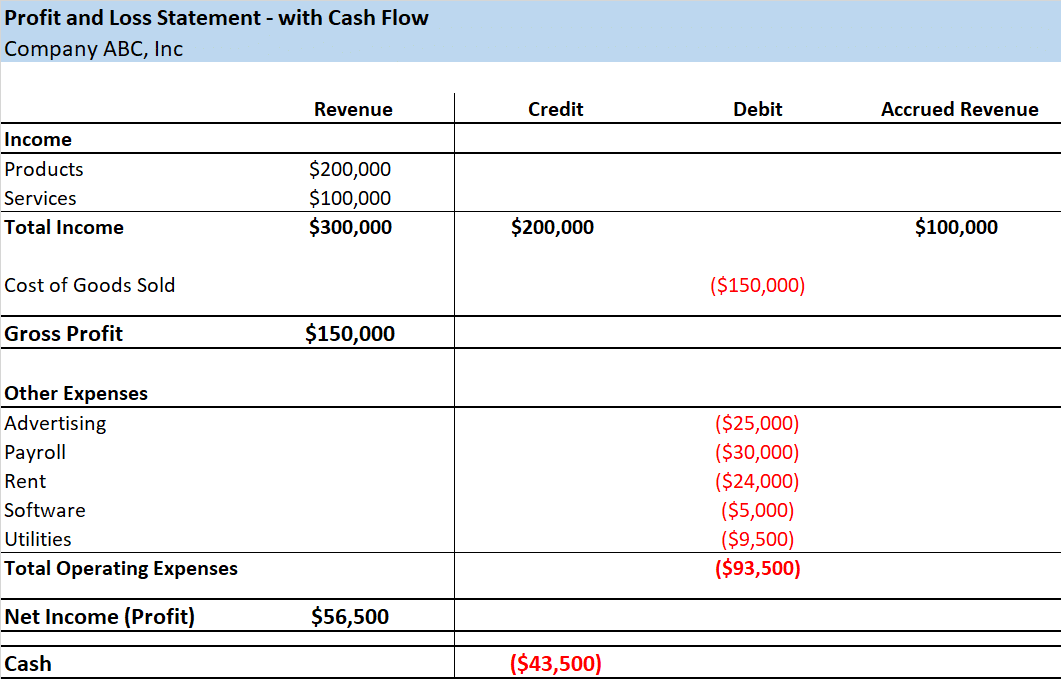

Now let's consider the cash flow side of the financial statement.

Let's say from the $300,000 in revenue, your clients are paying you in monthly installments for 6 months.

Here's what your financial statement looks like now:

So while you have an income of $56,000, you don't have the cash available to pay the employees, purchase new equipment, expand inventory, etc.

You may have heard the statement:

“Cash Rules!!!”

In business, this is behind this statement is quite simple.

It puts you in a stronger position with regards to buying power.

Growing a business can place a stress on cash flow, which explains why 29% of companies state losing sight of business because of lack of cash.

Options to enhance Cash Flow

You may not have enough cash on hand to cover your expenses at a given time. And that's normal and to be expected for smaller businesses (and even larger businesses).

Here are several options to help you conserve a healthy income:

1 – Improve your payment terms with your clients. Consider changing from the net 60 to net 30

2 – Offer small discounts to early payers. It doesn't need to be much, with respect to the amount your client owes, something as small as a 2% discount if paid within 7 days may have the desired effect.

3 – Make use of your business charge card when purchasing good. Just be sure you pay this off immediately so you do not pay the eye rates.

4 – Place your cash to operate – consider a high interest business savings account

5 – Consider a business line of credit, working capital advance or any other type of funding option. This is when Small Business Funding can help. We provide you use of quick working capital. In many instances you could get funding within 3 days.

Conclusion

Keep an eye on your money flow and forecast out in to anticipate when your income may be low. This is where a small company loan can help ensure a steady income, especially throughout the startup and expansion of your company.